Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

When it comes to building wealth, understanding long-term capital gains tax can be crucial for savvy investors. If you’re after securing your future while maximizing profits, this guide is designed to help you navigate the ins and outs of investment options for long-term capital gains. Knowing how these investment avenues work can pave the way towards financial freedom.

Investing smartly is the name of the game. The goal is to grow your wealth over time while keeping an eye on the tax implications of your investments. Here are some investment options to consider:

Investing in stocks or equity mutual funds can provide solid returns over time. When you hold onto your shares for over a year before selling, the gains from the sale may qualify for long-term capital gains tax benefits. This means you can keep more of your hard-earned money working for you.

Buying property is a classic investment option that can yield significant long-term gains. Unlike stocks, real estate often appreciates over time, making it a solid choice for building wealth. Also, if you hold onto your property for more than a year, the profits you make selling it could get taxed at a lower rate than your ordinary income. It’s a win-win!

Contributing to a retirement account like an IRA or 401(k) allows your investment to grow tax-deferred, meaning you can benefit from long-term gains without immediate tax implications. Just remember, taxes will come into play once you start withdrawing from these accounts, but the wait often pays off.

Aside from stocks and real estate, there are various other pathways to consider. Let’s dig deeper into those that can help boost your capital gains:

Index funds are an attractive option for investors looking for diversification at a lower cost. Since they often mimic market indices, your money is spread across many investments. These funds typically generate long-term capital gains, especially when held for over a year.

Similar to index funds, ETFs provide a way to invest across various sectors without pouring all your money into individual stocks. The key thing about ETFs is that they generally incur lower fees compared to mutual funds, maximizing your growth potential when capital gains kick in.

If your focus is on minimizing tax implications, consider tax-efficient funds. These funds aim to minimize capital gains distributions, allowing you to keep more of your returns. Suitable for longer investment horizons, they can be a great asset in your portfolio.

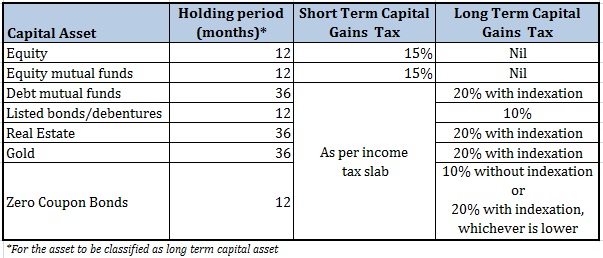

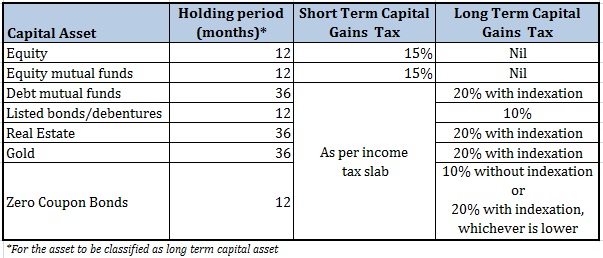

Understanding capital gains tax can seem daunting, but knowledge is power! Here’s a breakdown:

When you sell an asset for more than you paid, the profit is labeled as a capital gain. If you hold onto that asset for over a year, that gain is considered long-term, typically taxed at a lower rate than short-term gains, which apply to assets sold within a year.

The tax rate for long-term capital gains generally falls between 0% to 20% based on your income level. It’s crucial to familiarize yourself with these rates to make informed investment decisions!

Long-term investments not only provide potential for significant capital gains but also foster a patient, strategic mindset when it comes to growing your wealth. Here are some more thoughts:

Adopting a long-term perspective allows you to weather market volatility and compound your returns over the years. This approach helps you avoid frequent trading costs and taxes on short-term gains, ultimately enhancing your wealth-building strategies.

Staying committed to long-term investments requires discipline. It’s all too easy to get swayed by market noise or short-lived trends, but the long game usually pays off. Remember to periodically review your portfolio but don’t get caught in the whirlwind of daily market ups and downs.

Investing in options that favor long-term capital gains is a stepping stone toward achieving financial success. By understanding how long-term gains work and exploring various investment paths, you’re on your way to making well-informed decisions that align with your financial goals.