Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Welcome to the wild and wacky world of crypto trading! If you’ve found yourself staring at charts and feeling like you’re trying to decode ancient hieroglyphs, fear not! You’re not alone. Today, we’re embarking on a hilarious journey through the land of Technical Analysis: Master Charts and Indicators for Stock Trading. Buckle up; it’s going to be a bumpy—but entertaining—ride!

Picture this: you’re at a cocktail party, and someone pulls out a chart of Bitcoin prices. You squint, nod sagely, and pretend to understand what in the world is happening. Meanwhile, your brain is screaming, “What is this sorcery?!” But hang on! Technical Analysis: Master Charts and Indicators for Stock Trading isn’t just for math wizards and day traders—it’s for everyone! Yes, even you! So grab your (metaphorical) wizard hat and let’s dive in.

When you think of technical analysis, you might envision a group of people in lab coats, flipping through graphs and mumbling about RSI (Relative Strength Index, not Rocket Ship Initiative, though that sounds fun!). But fear not, dear reader! You don’t need a doctorate in chartology to get ahead. In fact, understanding the basics is like learning to ride a bike—wobbly at first, but eventually, you’ll be cruising along the crypto highway!

Now, let’s talk about charts. Oh, the beautiful charts! They’re like artwork but with beeps and boops. The three main types are line charts, bar charts, and candlestick charts (which may or may not be made of candy). Each provides a different flavor of insight. But remember—don’t feast on charts like they’re a buffet. Measure your intake, or you might end up with a hefty spreadsheet hangover!

If charts are the peanut butter, then indicators are the jelly that makes technical analysis truly delightful. We’ve got Moving Averages (no, this isn’t about how fast you can run), the MACD (which sounds like an elusive secret agent), and Bollinger Bands (no, it’s not a new boy band). These indicators help traders make sense of the market, even when it tries its best to confuse them. With a bit of practice, you’ll be interpreting these like a pro in no time!

After mastering the art of chart reading and making friends with indicators, you’ll be ready for the main event: trading! But wait! Before you dive in headfirst like a toddler in a ball pit, let’s set some ground rules. Trading without a plan is like going to the grocery store hungry—you’ll end up with way more than you intended and probably some strange choices too.

So, here’s the kicker: you need a strategy. Whether you’re HODLing, day trading, or scalping (which isn’t just a fancy word for haircuts), having a plan will save you time, money, and possibly your sanity. Each approach has its quirks, and it’s time to find the one that fits your personality like a cozy blanket on a chilly day.

As you mingle with market trends and ride the waves of prices, remember that technical analysis is both an art and a science. No algorithm can predict the market’s next move with 100% accuracy. It’s like trying to figure out what your cat is thinking—impossible! You may think you’ve mastered it, but the market has its mysterious ways.

Now, let’s talk about Fibonacci. No, not the guy who invented pasta! We’re referring to Fibonacci retracement levels, which sound fancy and are actually quite useful. It’s a series that helps traders figure out where to expect resistance and support levels. It’s like having a roadmap that can guide you to keep your sanity if the market starts dancing unexpectedly. Who knew it could be this entertaining?

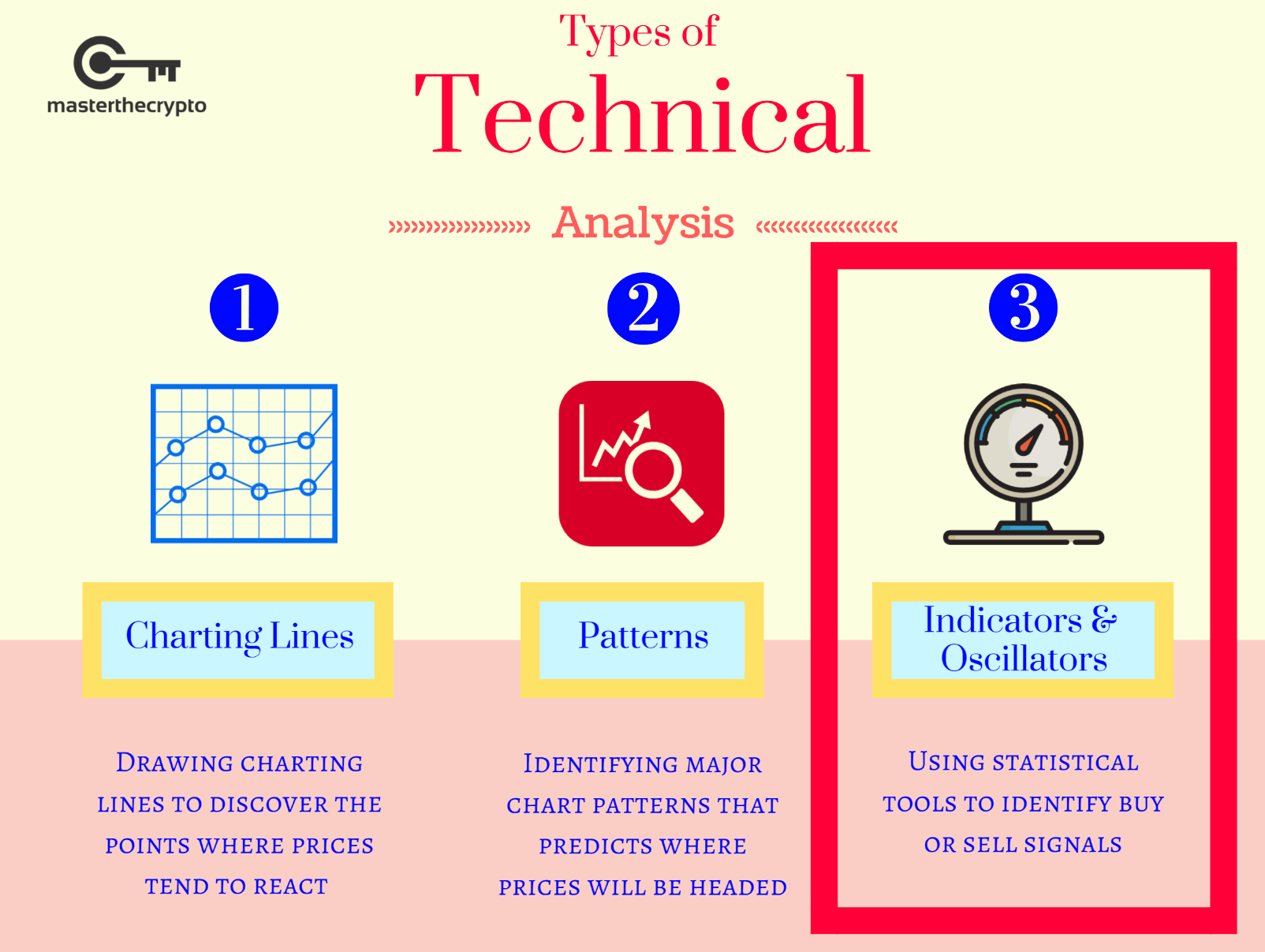

Curious about what technical analysis looks like in action? Feast your eyes on this visual delight!

This image showcases the variety of indicators you can play around with. Just don’t get too attached—like that one friend who always borrows money, they might not be there for you when you need them!

Congratulations, savvy trader! You’ve now got the tools to play in the big leagues. The next time your friends talk about crypto, you won’t just nod—oh no, you’ll jump into the conversation with gusto, armed with your newfound knowledge. Technical Analysis: Master Charts and Indicators for Stock Trading is your secret weapon in this ever-changing landscape.

Remember, whether you’re observing market trends while sipping on your morning coffee or trying to make sense of the latest crypto news, always keep a sense of humor. Markets rise, markets fall, but at the end of the day, it’s all part of the wild ride we call investing!

And if you ever feel overwhelmed, just take a step back, breathe, and remember that even the best traders sometimes look back at their decisions and laugh. Because, let’s face it, trading can sometimes be a comedy of errors, but it’s all about the journey, isn’t it? So, dear reader, embrace the chaos and keep laughing while you master the art of Technical Analysis!