Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In an ever-changing world, it’s vital for faith-based organizations to consider their financial security while journeying towards a safer future. Churches are compelling entities that not only serve spiritual needs but also stand as pillars of their communities. As such, investing wisely becomes a crucial aspect of sustaining their mission and outreach.

Encouraging safe investments for churches protects assets while fostering growth, ensuring that they can fulfill their responsibilities effectively. This guide highlights the importance of implementing strategic financial decisions that empower church leaders and congregations alike.

When it comes to church finances, the focus should always be on longevity and security. Safe investments for churches are essential in maintaining their operations and supporting community initiatives. The relentless economic shifts can pose threats to financial health, making it even more important to adopt a cautious approach to investing. Safety should be the priority, not just potential gains.

There are many options for churches to consider when it comes to safe investments. These investments should not only protect their assets but also allow for growth and sustainability over time. Some choices include:

Developing a long-term strategy that incorporates safe investments for churches is critical. This involves not only selecting the right investment vehicles but also establishing a financial plan that supports the church’s mission. Churches should consider creating a finance committee tasked with overseeing this aspect of the church’s operations.

A comprehensive financial plan will encompass various elements, including:

Engaging the congregation in discussions about financial stewardship helps create a culture of transparency and trust. By fostering open conversations about safe investments for churches, leaders can inspire members to take an active part in the church’s financial health. This not only bolsters community trust but also encourages tithing and donation practices.

Education is vital in fostering understanding about the importance of safe investments for churches. Workshops, seminars, and informational sessions can be held to guide church members on responsible giving and investment practices. Discussing their impact on the church’s mission and future will enhance the congregation’s commitment and participation.

For any investment, understanding the risks involved is paramount. Churches should develop a risk management strategy that identifies potential threats to their financial investments. This might involve seeking expert advice from financial consultants specializing in non-profit organizations. Risk assessment criteria can help inform better investment decisions.

Finding a financial advisor with expertise in church investments can provide invaluable insights. These professionals can guide churches in diversifying their portfolios to enhance safety and security. Effective advisors can also help churches navigate complex tax laws, maximizing their investment returns with compliance in mind.

In today’s digital world, leveraging technology can bolster safe investments for churches. Financial management software provides tools for budgeting and forecasting, helping to streamline financial processes. This technology can also assist in tracking investment performance, offering real-time updates to church leaders.

Online platforms can serve dual purposes: connecting with congregants and monitoring financial contributions. Utilizing apps for donations enhances the giving experience, allowing members to contribute easily and securely. A transparent system of financial reporting can foster trust and encourage more active participation.

Ethics play a critical role in shaping the types of investments a church may choose to pursue. Adopting socially responsible investment (SRI) strategies can align investment choices with the church’s values and missions. Safe investments for churches should also consider the ethical implications of where money is being allocated. By prioritizing investments in businesses that promote social justice and environmental sustainability, churches can ensure that their money contributes positively to society.

Impact investing is another avenue for churches to explore. This approach seeks not only financial return but also social impact. By investing in projects that promote community development or support other non-profit initiatives, churches can enhance their financial model while becoming agents of change.

As time progresses, it’s crucial for churches to remain diligent in monitoring their investments. Trends in the financial market can shift rapidly, necessitating a proactive approach to investment strategies. Regularly scheduled reviews can help identify areas for improvement and ensure alignment with overall church goals.

Resilience in investment strategies is vital for churches to withstand potential economic downturns. Safe investments for churches should be well-structured to weather economic fluctuations. Utilizing diversified strategies and having an adaptive mindset can prepare churches to face any financial storm with strength.

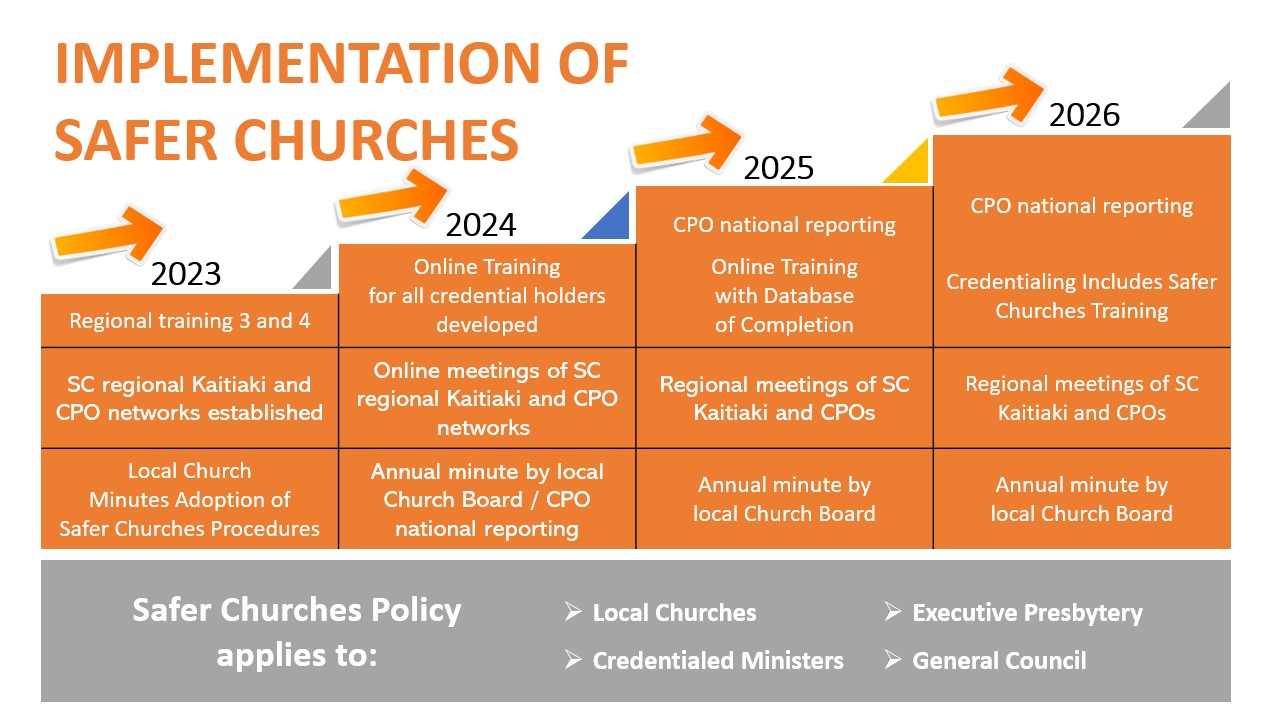

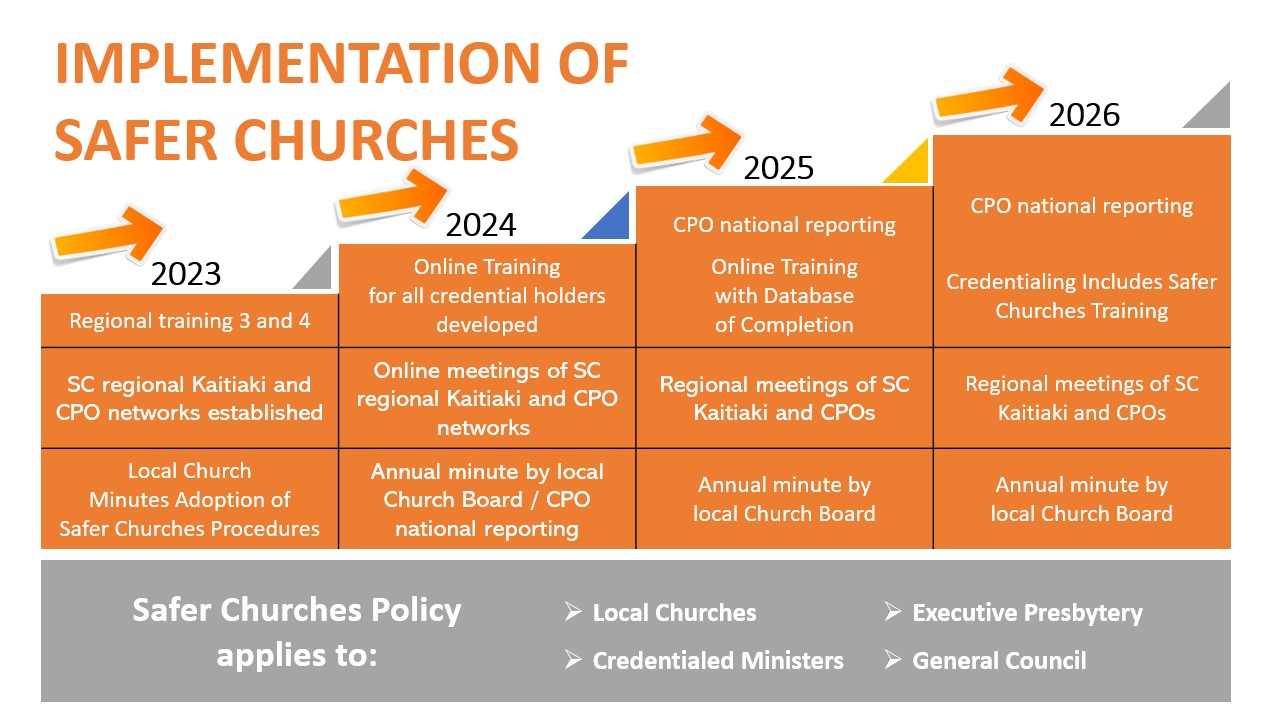

This visual represents our commitment to ensuring financial safety for churches—an essential step towards fulfilling our mission more effectively. Protecting community assets allows churches to invest in impactful programs and outreach initiatives, paving the way for a brighter future.

In conclusion, safe investments for churches are not just about preserving finances; they are about empowering communities. By prioritizing financial education, risk management, and ethical investing, churches can establish a solid foundation for future growth and sustainability. This journey requires diligence, engagement, and a commitment to uphold the core values of faith-based organizations while navigating the complexities of financial management. Together, we can foster a brighter, safer future for our treasured places of worship.