Managing personal finances is essential for achieving financial stability and success. In today’s world, where costs can spiral and financial pitfalls are common, having a solid grasp on one’s financial situation is more important than ever. This guide aims to equip individuals with tips and resources on managing personal finances effectively, ensuring that you are well-prepared in your financial journey.

Understanding the Importance of Managing Personal Finances PDF

When it comes to managing one’s financial health, many individuals benefit from having tangible resources they can refer to. One of the best ways to keep track of your financial goals, budgets, and spending patterns is by utilizing a managing personal finances PDF. This resource allows you to maintain organized records and establish clear goals for the future.

What is a Managing Personal Finances PDF?

A managing personal finances PDF is typically a document that outlines the key aspects of budgeting, expense tracking, and financial planning. By utilizing such a resource, individuals can better understand how to allocate their income and make informed decisions about their spending habits. This PDF can come with templates, guides, and concise explanations to help simplify complex financial concepts. Understanding these documents is critical for those wishing to take charge of their financial lives.

Visualizing the Concept of Financial Management

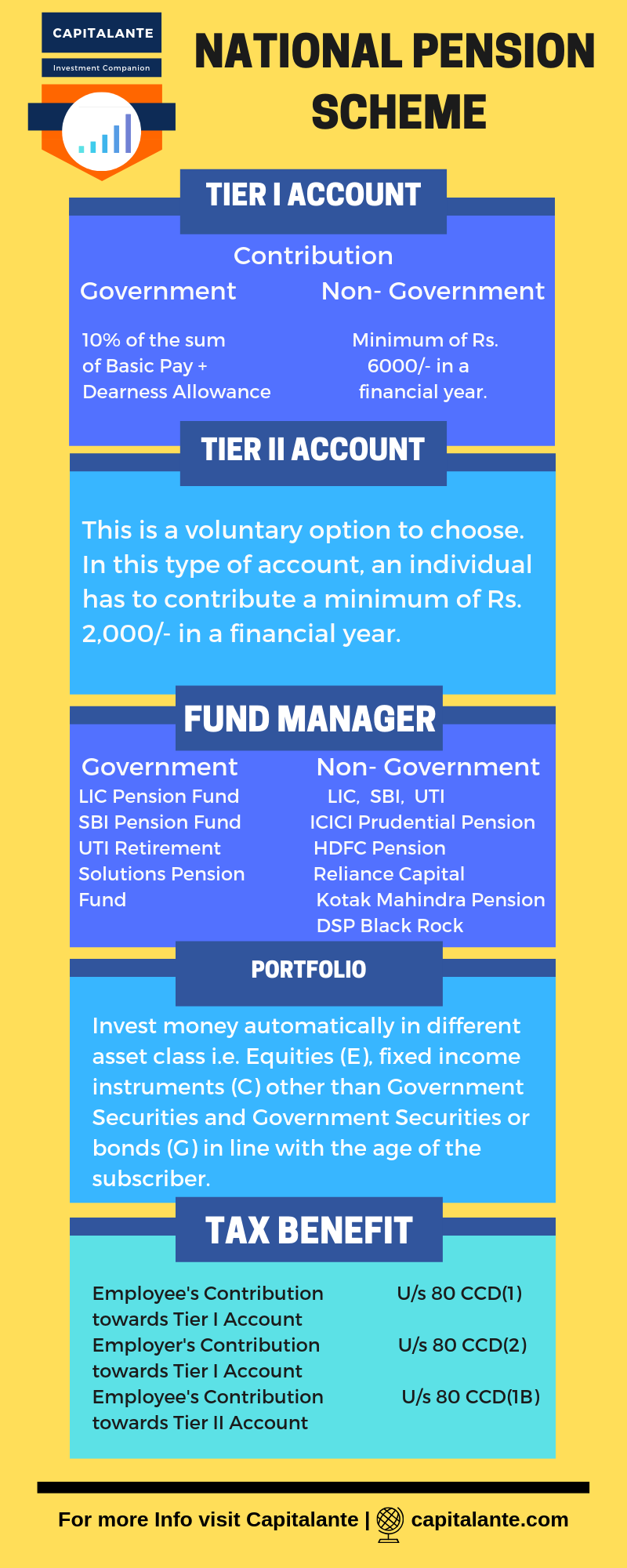

This image encapsulates the essence of the concepts we are discussing. It represents the commitment to understanding and mastering personal finances. Courses and resources can provide insight into how to better manage one’s finances, especially through online platforms.

The Components of a Comprehensive Managing Personal Finances PDF

Creating or utilizing a managing personal finances PDF requires careful consideration of several key components. Here are some essential elements to include:

- Budgeting Templates: A robust managing personal finances PDF should feature budgeting templates that allow individuals to input their income sources and expenses. These templates help in visualizing how money flows in and out and highlight areas where adjustments may be necessary.

- Expense Tracking: Effective expense tracking is essential for identifying spending behavior. Including a section in your managing personal finances PDF dedicated to expense tracking will enable individuals to discern trends over time and areas of potential savings.

- Goals Setting: Setting short-term and long-term financial goals is a vital aspect of personal finance. Incorporating a goal-setting section in your PDF can assist in providing clarity on what you’re aiming to achieve, whether it’s saving for a vacation, paying off debt, or investing for retirement.

- Financial Planning Tools: Including tools and resources for financial planning can empower individuals to make proactive decisions regarding investments and savings. This may include retirement calculators, debt repayment plans, or information on different investment vehicles.

- Emergency Fund Guidelines: In today’s uncertain financial world, establishing an emergency fund is crucial. Your managing personal finances PDF should offer guidelines on how to build this fund and the recommended amount to have saved.

Tips for Utilizing Your Managing Personal Finances PDF Effectively

Once you have your managing personal finances PDF, it’s essential to use it effectively. Here are some tips to enhance your experience:

- Regular Reviews: Set a specific time each month to review your financial situation using your PDF. Consistent reviews allow you to adjust your strategies and ensure that you are on track to meet your financial goals.

- Stay Honest with Yourself: Full transparency within your managing personal finances PDF is crucial for success. Be honest about your income and expenses to create a realistic plan.

- Commit to Continuous Education: The world of finance is ever-evolving. Commit to continuous learning by seeking additional resources, such as books, online courses, or financial workshops.

- Seek Professional Advice: If you’re struggling to navigate your financial waters, don’t hesitate to seek advice from financial professionals. They can guide you in tailoring your managing personal finances PDF to your unique situation.

Additional Resources to Consider

In conjunction with your managing personal finances PDF, consider exploring other resources that can provide positive reinforcement and further knowledge:

- Webinars and Online Courses: Take advantage of online courses that provide deeper insight into specific topics related to personal finance.

- Financial Apps: Utilize apps that sync with your bank accounts to help track spending in real-time, providing you with an up-to-date view of your finances.

- Financial Books: There are countless books dedicated to personal finance. Invest time in reading these materials to enhance your understanding.

- Community Groups or Workshops: Engage with community groups or attend workshops. Sharing experiences and learning from others can be invaluable.

Wrapping It Up

Managing personal finances effectively is a critical skill that everyone should strive to develop. By utilizing a managing personal finances PDF along with supportive resources, individuals are empowered to take charge of their financial destinies. From establishing a budget to tracking expenses and setting achievable financial goals, proactive management of personal finances can lead to security and wealth accumulation. Remember, the journey to financial independence begins with knowledge and deliberate planning. Commit to enhancing your financial literacy, stay disciplined in your approach, and remain adaptable to change. This will ensure you navigate through any financial storm successfully.