Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Welcome to the whimsical world of personal finance management, where the dollars dance and the cents sing! You may think managing your personal finances is as exciting as watching paint dry, but trust me, we can turn that frown upside down! Whether you’re trying to figure out how to manage my personal finance or just looking for a way to afford that quintuple shot artisanal coffee, I’ve got the tips and tricks for you.

Ah, budgeting. The necessary evil. It’s kind of like doing the dishes—nobody really wants to, but it must be done. And just like washing those stubborn pots and pans, creating a budget can be pretty satisfying once you see the results. The beauty of budgeting is that you get to dictate where your money goes. Spoiler alert: it should definitely not go to that late-night pizza delivery every Tuesday!

Start by gathering all your financial statements, your incoming cash flow, and your outgoing expenses. Yes, you may need a magnifying glass to read those tiny numbers, but it’s worth it! Now, divide your expenses into fixed and variable. Fixed expenses are those pesky bills—rent, utilities, the leash for your pet iguana if that’s your thing. Variable expenses are your entertainment and food costs—aka, “The Fun Stuff.” Next, set up some categories for your budget and allocate funds accordingly. Remember to include some fun money; after all, you can’t eat instant ramen every day…well, not AND have a good social life.

Once you’ve implemented your budget, it’s time to envision your financial future. This is where you can get creative! I like to think of it like crafting your personal finance masterpiece. You can even visualize your goals in a collage. Make it pretty! Pin pictures of what you want on your wall. A new car? Your dream vacation? Those cute shoes you’ve been eyeing since last spring? Go wild!

Here’s a helpful hint: Make sure your goals are SMART—Specific, Measurable, Achievable, Relevant, and Time-bound. You don’t want to say, “I will buy a yacht one day,” because then you might be stuck in debt before you even hit the high seas! Instead, say, “In three years, I will have saved $20,000 for a used sailboat with a working engine.” Now that’s specific!

Now, we all know the golden rule: pay yourself first! Your savings deserve to be funded before that shiny new gadget catches your eye. Set up an automatic transfer to your savings account—consider it like feeding a pet, except it’s not noisy and doesn’t need to be taken on walks. Aim to save at least 20% of your income, even if that means skipping an evening snack run for tacos with the squad.

Ah, compound interest, the eighth wonder of the world! Or at least it should be. If you ever find yourself pondering how to manage my personal finance, just remember that a penny today is worth more than a penny tomorrow. Invest in an index fund, let that money marinate, and watch as it grows just like that sourdough starter kicking off some serious bubbles in your kitchen.

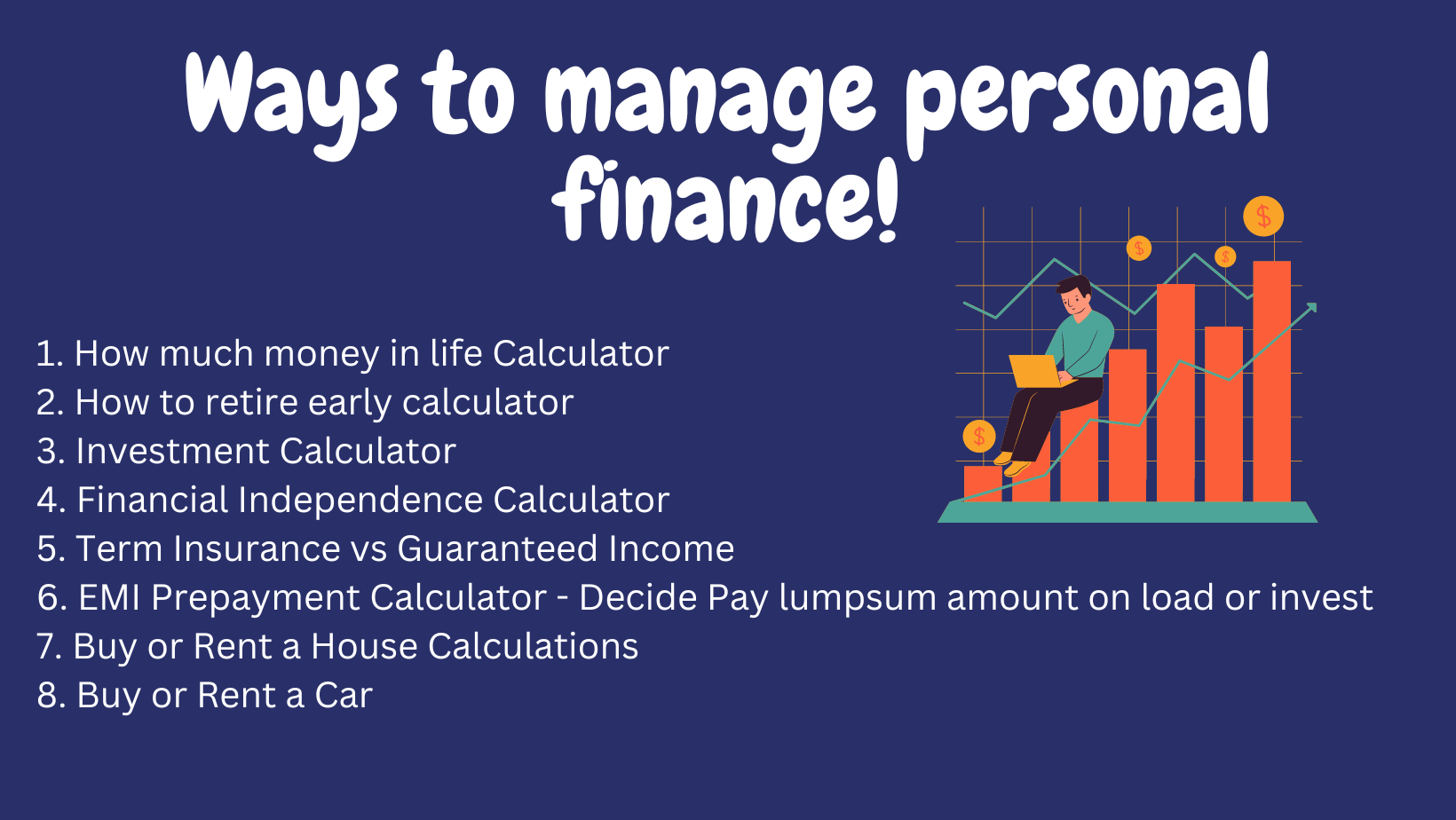

This image gives you a visual eagerness to start saving! Now, wouldn’t it be lovely to see numbers growing like mythical unicorns? Well, maybe not quite like that, but you get the drift.

Saving doesn’t have to be a drag! In fact, let’s spice it up. Create a “savings challenge”—maybe a dollar-a-day challenge or the infamous 52-week challenge. How about a “change jar” where every coin you find on the street makes its way into a jar, ready to be opened at the end of the year for a surprise fun trip? And hey, those pennies add up! I mean, who knows what treasures you may find in the cushions of your couch?

We’ve chatted about saving, but let’s talk about making that money grow! What better topic than investing? Think of it as a party for your money, and you’re the DJ, mixing and matching until you find the perfect beat. The stock market can feel a bit like a rollercoaster ride—just remember to hold on tight and scream if you must!

For beginners, consider Exchange-Traded Funds (ETFs) or mutual funds. They offer diversification, which is a fancy way of saying you’re not putting all your eggs in one basket. And trust me; you don’t want to drop that basket on your foot! If you find investing intimidating, reach out to a financial advisor—or a wise owl in your life who knows a thing or two. They can help guide you as you find your rhythm in the wild world of investments.

Embarking on your financial journey can feel daunting, but remember, every expert was once a beginner. As you navigate the ins and outs of personal finance, from budgeting to savings to investments, don’t forget to celebrate your small wins! Actually, treat yourself to an ice cream after reaching your savings goal or a movie night with friends—just don’t break the bank this time!

As you proceed with how to manage my personal finance, you’ll find that it’s not only about the numbers; it’s about the mindset, the planning, and ultimately, your happiness. Let’s get started on this exciting and often hilarious journey together! So grab your calculators, get a good grasp on that budgeting app, and let’s go! Happy managing!