Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

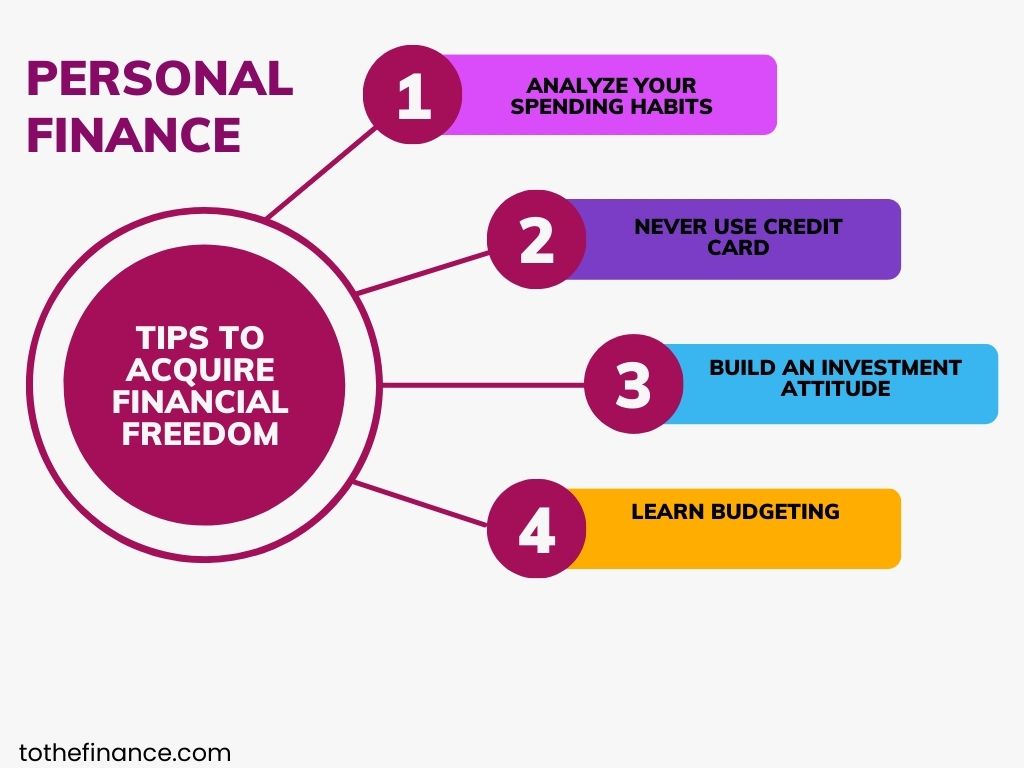

Mastering the art of personal finance is no walk in the park. It requires dedication, patience, and a bit of grit, particularly for beginners navigating the complex landscape of budgeting and saving money. For those in Perth looking to get their financial house in order, understanding basic personal finance tips can set the stage for a successful financial future. In this guide, we’ll discuss essential personal finance tips for beginners Perth can take to heart, offering practical advice and strategies you can implement today.

Having a clear image of where you stand financially is the first step toward financial stability. Documenting income and expenditures can provide perspective and prevent unnecessary overspending. In our quest for personal finance tips for beginners Perth residents can find particularly relevant, keeping a spending log can reveal trends that may not be immediately obvious.

Budgeting is the cornerstone of effective personal finance management. It’s easy to get caught up in the day-to-day of life in Perth—dining out, enjoying local attractions, and shopping can lead to financial slip-ups. A detailed budget helps local residents track their income against their expenses, identifying areas where they can cut back. A zero-based budget is particularly effective; every dollar is accounted for, and you ensure that your income minus expenses equals zero. This method, a key personal finance tip for beginners Perth can adopt, actively encourages mindfulness about spending habits.

One of the most critical personal finance tips for beginners Perth residents should embrace is the importance of creating an emergency fund. Life is unpredictable, and having a financial cushion can help you weather unexpected situations without resorting to debt. Aim for three to six months’ worth of living expenses. Begin by saving a small amount regularly, and gradually increase your contributions as your budget allows. Remember, the goal is to build this fund without dipping into it except for real emergencies.

Overcoming debt should be a priority in anyone’s financial journey. For beginners exploring personal finance tips in Perth, understanding the difference between good and bad debt can empower you to make informed decisions. Good debt—like student loans or a mortgage—can lead to increased wealth over time, while bad debt, such as credit card debt with high interest rates, can derail your financial plans.

Creating a debt repayment plan can help you strategically tackle what you owe. Methods like the snowball method (paying off smallest debts first) or the avalanche method (paying off highest interest-rate debts first) can work wonders. There are many apps and resources available to assist with monitoring and managing debts, providing essential tools needed to incorporate these personal finance tips for beginners Perth can utilize.

Investing might seem like a daunting commitment for beginners, but it’s one of the most effective ways to grow your wealth over time. With a clear understanding of personal finance tips, Perth residents should consider starting with low-cost index funds or retirement accounts like a superannuation fund. These options provide diversified exposure to the market without the hassle of picking individual stocks. Starting early can leverage compound interest in your favor, a fundamental concept that every beginner must grasp.

Understanding taxes is an essential part of personal finance. Beginners should familiarize themselves with the tax benefits available, such as deductions and credits that can ease the overall fiscal burden. Engaging with a tax professional or using reliable tax software can streamline the process. An important personal finance tip for beginners Perth can’t overlook is to always keep good records of expenses relating to tax deductions, which can lead to significant savings when tax time rolls around.

There are a multitude of resources to help you along your financial journey. From budgeting tools to investment apps, utilizing technology can simplify your life. Research personal finance blogs, podcasts, and workshops that discuss the intricacies of managing finances in Perth. There’s a wealth of information available, and tapping into these resources ensures you’re not navigating this journey alone.

Every financial misstep is an opportunity to grow and improve your understanding of personal finance. Don’t be afraid to analyze previous mistakes—whether it’s overspending or failing to save. Reflect, adjust, and move forward. Forging a strong relationship with your finances requires resilience and a willingness to learn from the past. Another essential personal finance tip for beginners Perth residents should remember is: every decision is a chance to build better habits.

Knowledge is power! Seek out educational resources that build your financial literacy. Countless workshops, online courses, and community events are offered around Perth that cater to all ages and financial backgrounds. By empowering yourself with information, you equip yourself to make wise financial decisions, an ultimate personal finance tip for beginners that sets individuals on the path to success.

Embarking on a journey of financial literacy and responsibility doesn’t have to be a lonely path. With these personal finance tips for beginners Perth can implement, you will gradually transform your relationship with money, paving the way for stability and growth. Always remember that the journey is a marathon, not a sprint—every small step leads to monumental changes in your financial future.

By embracing the advice shared here, you’re not only preparing yourself for immediate financial success but also building a lasting foundation that supports your long-term goals. As you evolve in your financial know-how, continue to seek new personal finance tips and adapt as necessary. Each decision will create ripples that can positively impact your life and open doors for opportunities in the long run.