Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In the world of finance, few names carry as much weight as BlackRock. This global investment management corporation has positioned itself as a powerhouse in the realm of assets under management. Investors and market analysts alike pay close attention to BlackRock’s movements due to its vast portfolio and strategic initiatives. In this discussion, we will dive deep into the implications of BlackRock’s money under management, its growth trajectory, and what it means for the broader market landscape.

When we talk about the investment management industry, the term “money under management” frequently surfaces. BlackRock stands out in this regard with its staggering amount of assets. As of recent reports, BlackRock manages trillions of dollars, making it the largest asset manager in the world. This staggering figure illustrates not only the company’s success but also the confidence investors place in its capabilities to navigate complex financial landscapes.

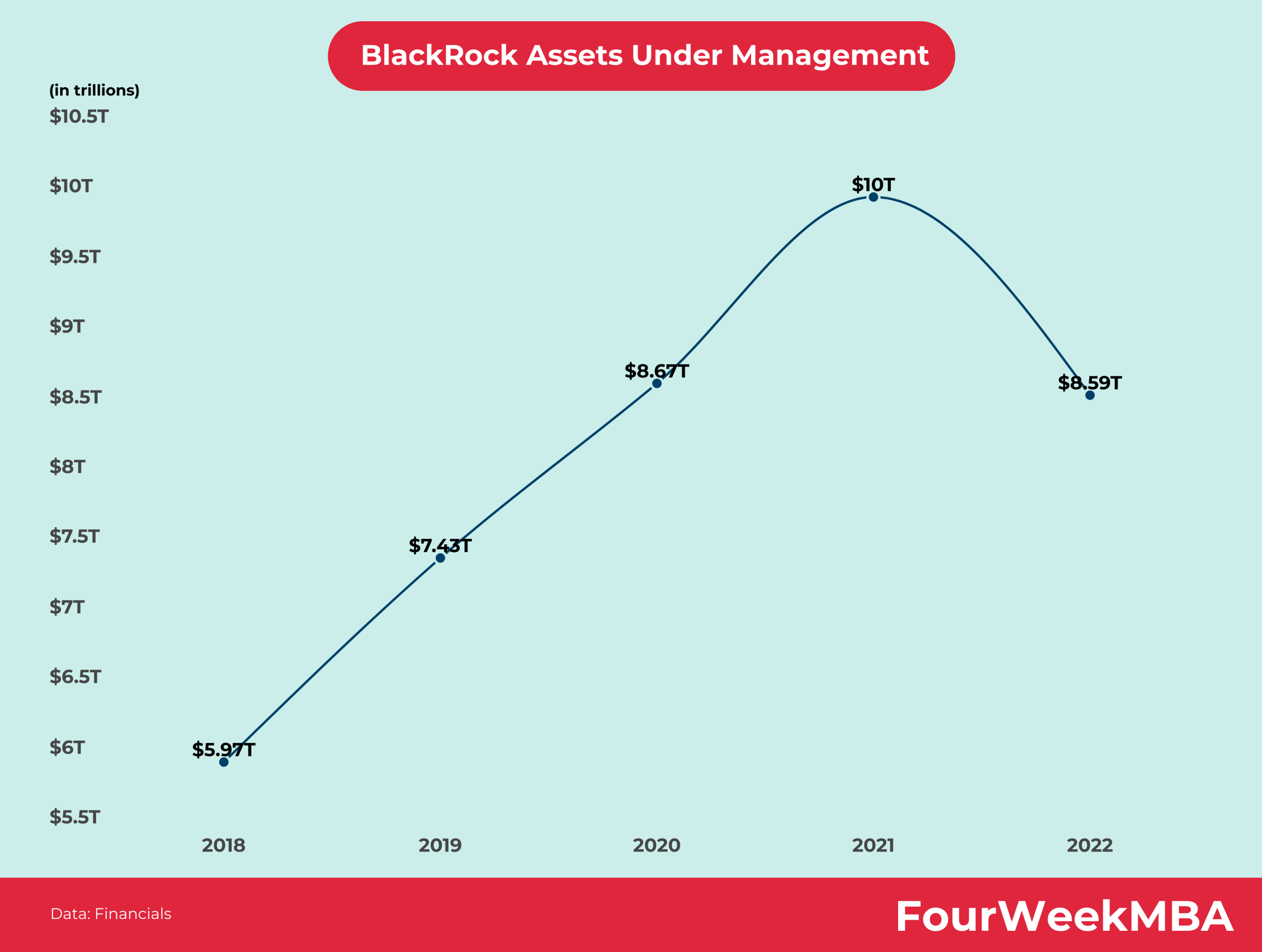

This image reflects the substantial growth of BlackRock’s assets over the years, demonstrating the company’s strategic investments and market resilience. As the market continues to evolve, understanding the implications of BlackRock’s assets can give investors valuable insights into potential opportunities and risks.

BlackRock’s money under management is not merely a number; it represents a significant component of the financial ecosystem. The company plays a crucial role in shaping market trends due to its extensive investment activity across various sectors. By managing such a vast amount of capital, BlackRock has the power to influence corporate strategies, funding mechanisms, and even policy decisions. This level of influence raises several questions about the responsibility asset managers hold in steering economic growth and stability.

At the heart of BlackRock’s success lies its sophisticated investment strategies. The firm’s approach combines cutting-edge technology with robust market insights, enabling it to adapt swiftly to changing market conditions. One of BlackRock’s notable innovations is its Aladdin platform, which provides data-driven analytics and risk management to clients. This platform allows BlackRock to efficiently manage its vast pool of assets while ensuring transparency and reducing operational risks.

Such technological integration is essential in today’s investment environment, where market conditions can shift rapidly. By leveraging advanced analytics, BlackRock can maintain an edge, ensuring that its money under management is deployed strategically across diverse asset classes.

For investors, the implications of BlackRock’s money under management extend beyond the numbers. The company’s investment decisions can affect stock prices, bond yields, and overall market sentiment. As a result, investors must keep a close eye on BlackRock’s strategies and market movements. BlackRock’s role as a major player in the financial markets poses both opportunities and challenges for individual and institutional investors alike.

When BlackRock makes significant investment decisions, the ripple effects can cause notable movements in the financial markets. For instance, if BlackRock decides to increase holdings in a specific sector, it can drive prices up, creating both opportunities and potential pitfalls for other investors. Often, market analysts look to BlackRock’s investment choices as indicators of where the market may be headed, making the company a key point of reference for many in the investment community.

This influence also underscores the notion of systemic risk. With so much money under management, decisions made by BlackRock can have outsized effects not just on individual stocks but on entire market sectors. As such, understanding their investment strategies and trends becomes crucial for anyone looking to navigate the complex world of finance.

Looking ahead, the future of BlackRock’s money under management appears poised for continued growth. With ongoing global uncertainties, such as economic fluctuations and geopolitical tensions, there is an increasing demand for robust asset management services. BlackRock’s ability to adapt and innovate means it is well-positioned to meet this demand. Factors such as environmental sustainability, technology integration, and diversification strategies will likely define BlackRock’s future investments.

Moreover, as more investors prioritize ESG (Environmental, Social, Governance) considerations, BlackRock’s compliance with these principles will be essential in retaining trust and attracting new clients. The firm’s focus on sustainable investing reflects broader societal trends, making it an interesting case study on how traditional investment firms can navigate changing consumer preferences.

In conclusion, BlackRock’s assets under management are more than just a figure; they represent the company’s pivotal role in the global financial landscape. The firm’s influence extends to various sectors, marking it as both a leader in investment strategy and a barometer for market health. For investors, aligning with BlackRock’s vision and understanding its strategies can lead to informed decision-making and potential growth opportunities.

As we continue to observe the developments in BlackRock’s strategies and their impacts, it’s clear that the narrative surrounding money under management will remain a critical component of the investment realm. Whether you are a seasoned investor or just beginning your journey, keeping BlackRock on your radar could provide valuable insights into future market trajectories.