Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In today’s fast-paced world, managing your finances can feel like an overwhelming task. It’s easy to get lost in a sea of expenses, bills, and savings plans. However, with the right budgeting tips, you can take control of your financial future, making informed decisions that align with your goals. This article delves into effective budgeting tips specifically tailored for those living in Ireland. Whether you’re just starting out or looking to refine your existing financial strategies, these insights will empower you to achieve financial stability and success. Let’s explore how you can harness these budgeting tips Ireland to create a life of financial freedom.

Before diving into specific budgeting strategies, it’s crucial to understand why these budgeting tips are particularly relevant in the Irish context. With fluctuating economic conditions, rising living costs, and the necessity for effective financial management, a solid budgeting plan can help you navigate through the complexities of financial obligations.

One of the first steps in creating a budget is setting clear and achievable financial goals. Start by assessing both your short-term and long-term objectives. Whether it’s saving for a holiday, buying a home, or building an emergency fund, defining your goals will provide direction.

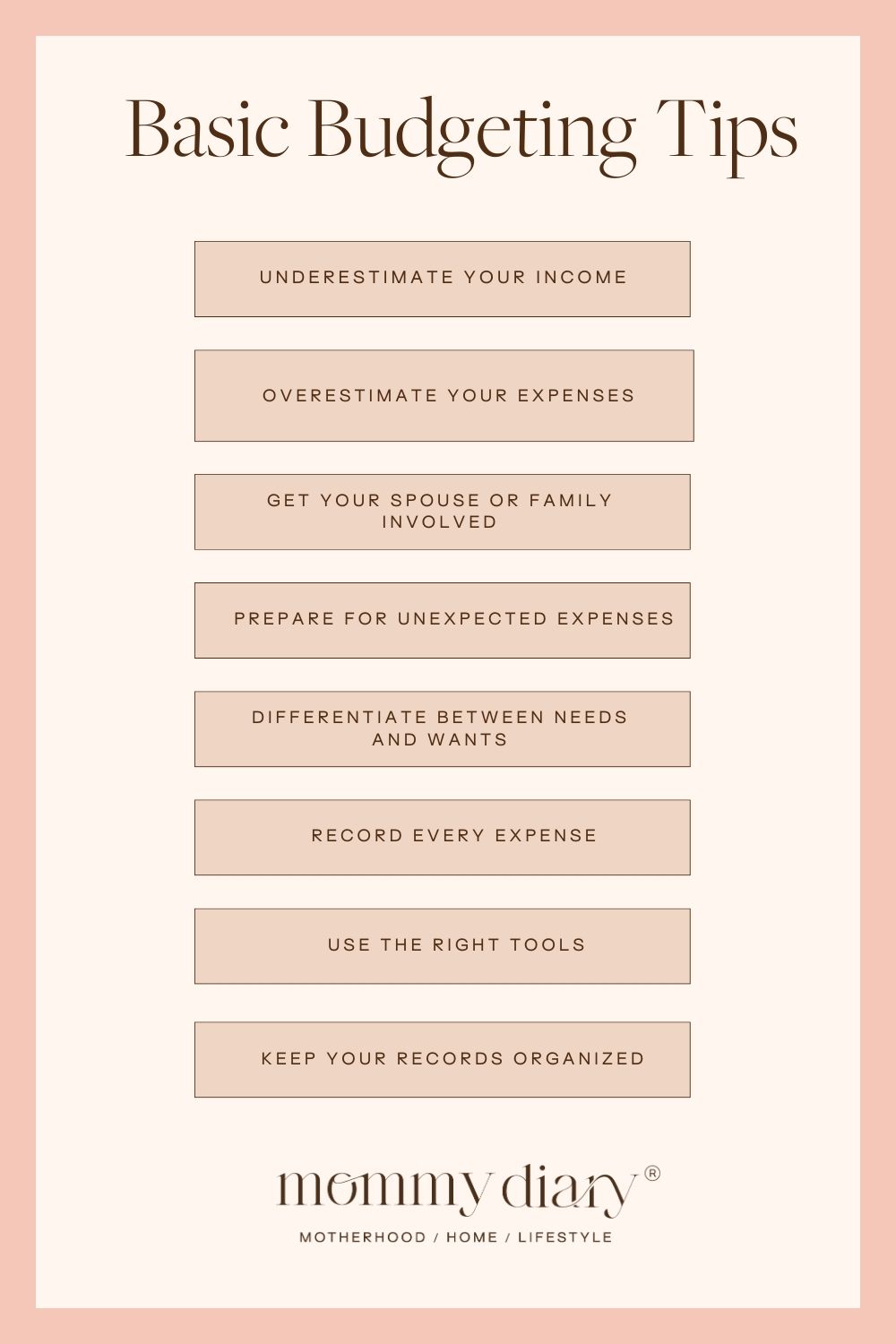

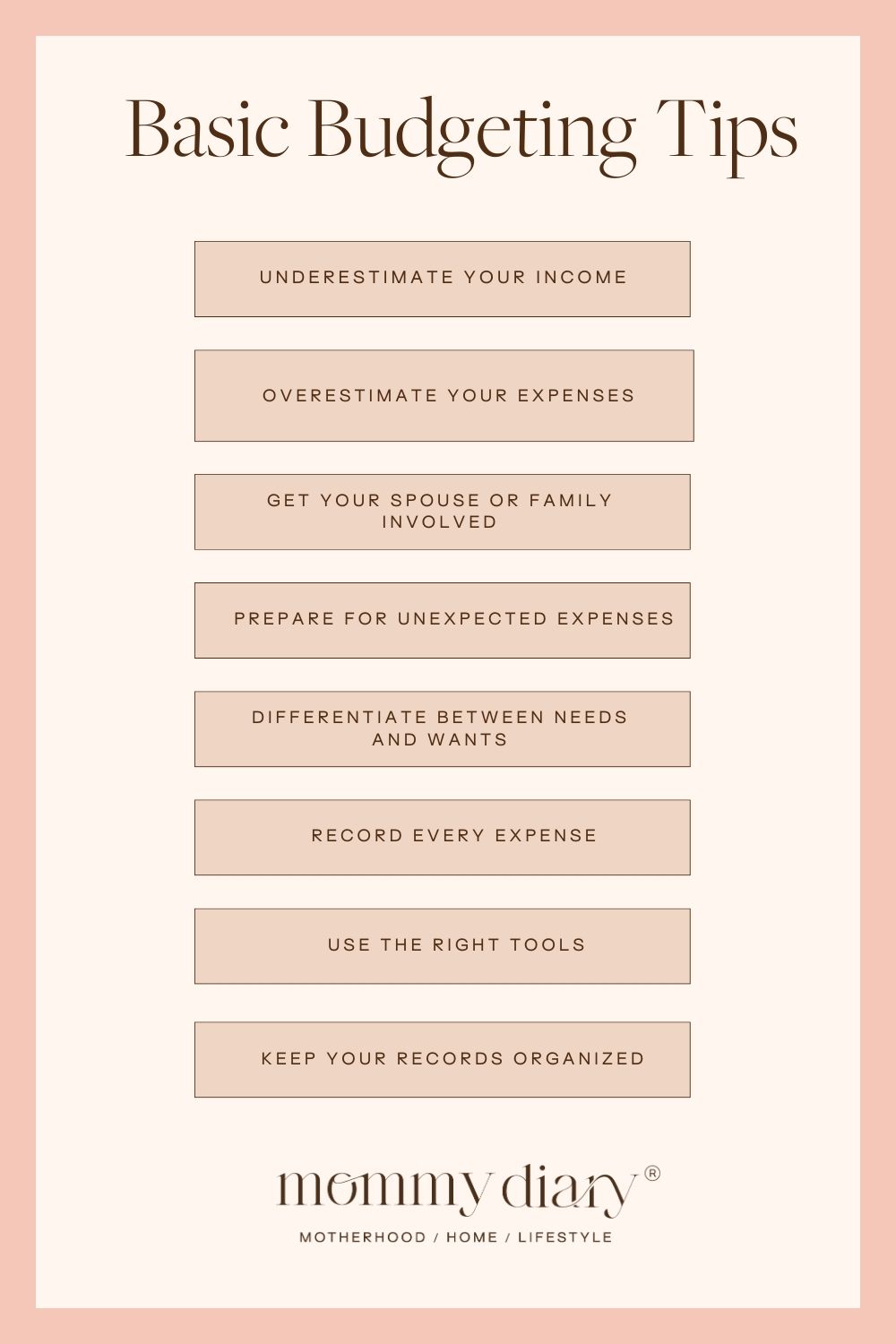

To effectively manage your finances, you need a comprehensive budget that includes all sources of income and every expense. Here are some effective budgeting tips Ireland:

Sometimes, seeing is believing. A well-crafted visual representation of your financial situation can be incredibly helpful. Create a chart or graph that displays your income against your expenses. By visualizing your financial journey, you can spot patterns and make necessary adjustments.

Incorporating saving into your budget is crucial for financial well-being. Aim to allocate a portion of your income to savings each month. Here are some powerful saving strategies:

Another critical component of effective budgeting is identifying areas where you can cut costs. Review your monthly expenses and see where you can make adjustments:

Staying committed to your budget can be challenging, especially when temptation strikes. Here are some tips to keep your motivation high:

Another effective way to improve your budgeting skills is by tapping into community resources. In Ireland, there are numerous programs and workshops designed to educate individuals about managing their finances effectively. Check out local community centers, libraries, or online platforms for workshops focused on budgeting tips Ireland.

With technology at our fingertips, there are numerous financial tools available that can help you stay on track. Consider using budgeting software or apps that provide features like expense tracking, goal setting, and reporting. These tools simplify the budgeting process and provide insights into your financial habits.

Budgeting is not a one-time activity but a dynamic exercise that requires ongoing evaluation. While sticking to a budget is essential, being too rigid can lead to frustration. Allow yourself some flexibility to accommodate life’s unexpected expenses.

Embracing effective budgeting tips Ireland is a powerful step toward achieving financial security. By setting clear goals, tracking your income and expenses, and being mindful of your spending habits, you can pave the way for a prosperous future. Remember, the journey to financial wellness is a marathon, not a sprint. Stay committed, remain flexible, and celebrate your progress along the way.

Finally, educating yourself about personal finance can significantly enhance your budgeting skills. There are numerous resources available online that offer guidance, tips, and tools to improve your financial literacy. Investing time in understanding these resources will pay dividends when it comes to managing your money effectively.

This visual guide encapsulates key elements of budgeting tips, offering insights that you can apply to your personal finances. Use it as a motivational tool as you embark on your journey toward better financial management.