Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Building a financial safety net is crucial for navigating life’s uncertainties. As individuals engage in their college journey, the concept of an emergency fund becomes vital not only for personal finance but also for academic success. An emergency fund can provide peace of mind and financial security, ensuring that unexpected expenses do not derail your educational experience. This post explores the concept of an emergency fund, particularly tailored for students at the University of Arizona, underscoring its importance and providing actionable strategies for building and maintaining your fund.

An emergency fund is a savings account specifically designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss. For University of Arizona students, having this fund is particularly essential due to the often unpredictable nature of college life and the financial burdens that can arise. The goal is to save enough to manage at least three to six months’ worth of living expenses, providing a cushion during tough times.

The financial landscape for students is multifaceted, with tuition, housing, and daily expenses all contributing to financial stress. Establishing an emergency fund not only alleviates immediate financial pressure but also fosters better financial habits for the future. By prioritizing savings, students can focus more on their studies and extracurricular activities rather than worrying about unforeseen expenses.

University students are often faced with unexpected costs that can arise at any moment. A broken laptop, medical bills, or even sudden travel expenses can catch anyone by surprise. Having a dedicated emergency fund allows you to respond to these challenges without resorting to high-interest loans or credit cards.

The first step in building an emergency fund is setting a realistic savings goal. Evaluate your monthly expenses and determine how much you will need to cover three to six months of living costs. This may seem daunting, but breaking it down into smaller monthly contributions can make this goal achievable. For example, if your monthly expenses total $800, aim for an emergency fund of at least $2,400.

Once you’ve determined your savings goal, the next step is creating a budget. Tracking your income and expenses will help you identify areas where you can cut back to allocate funds towards your emergency fund. Consider using budget tracking apps or tools that simplify this process. Remember, effective budgeting is a skill that can take time to develop, so be patient with yourself.

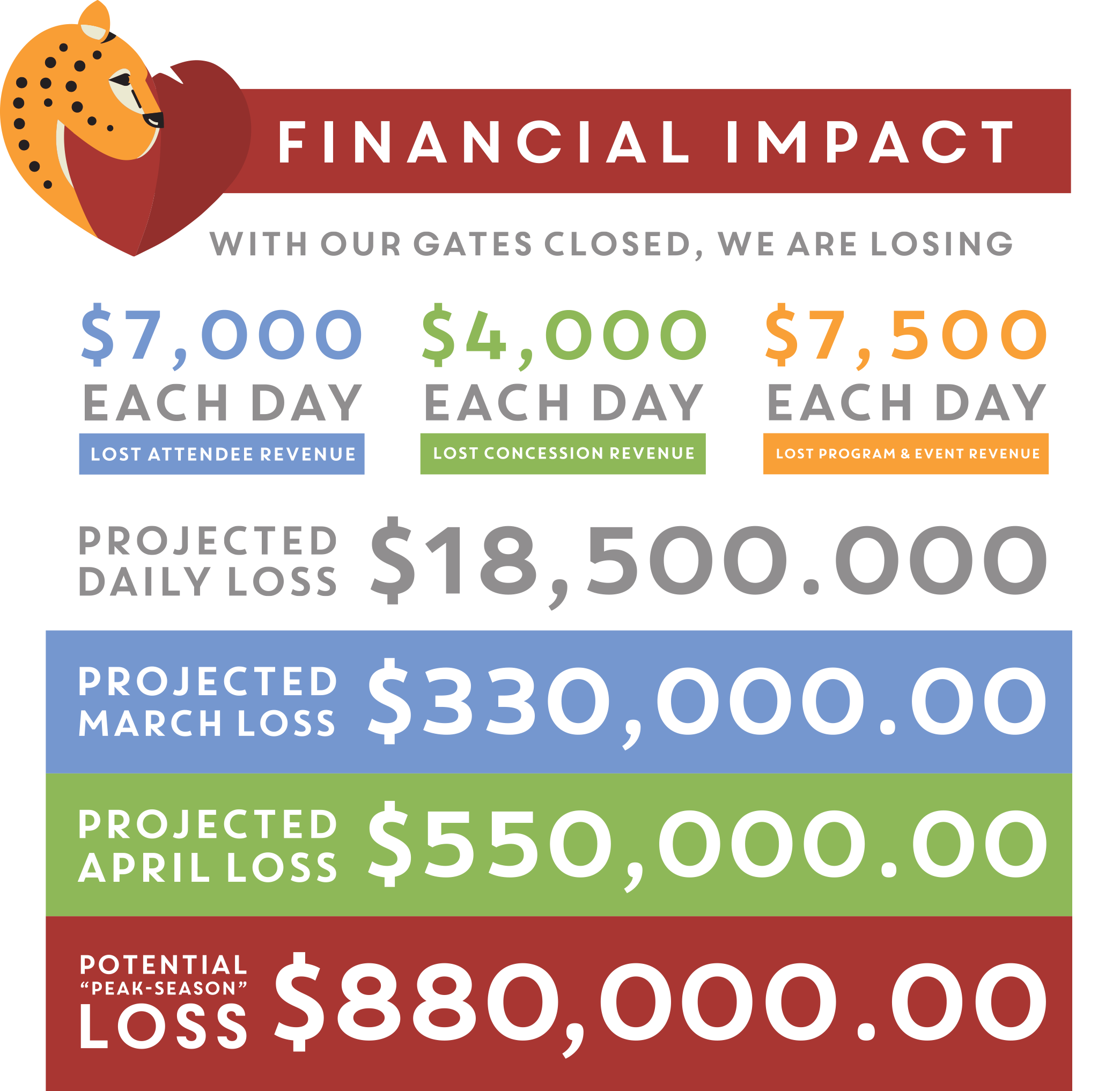

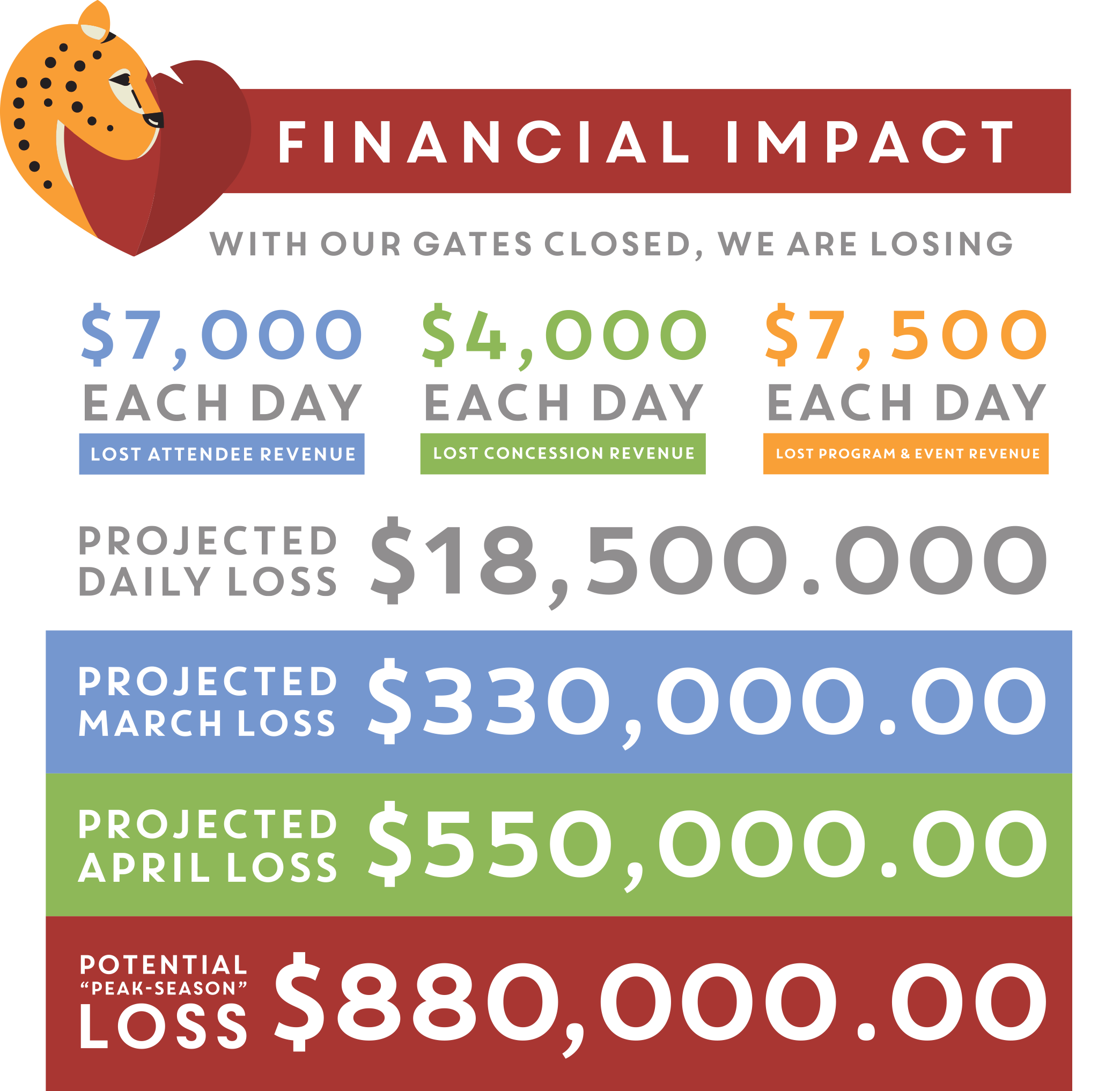

This infographic illustrates the significance of emergency funds and the factors that can lead to financial strain. As University of Arizona students, understanding these components will help you stay proactive with your finances.

Writing a monthly article on the importance of saving is beneficial, but the most crucial aspect is taking action. Start wherever you can. Even small contributions—like $10 or $20 a week—can accumulate over time. The key is consistency. Set up a separate savings account to keep your emergency fund separate from your regular spending money. This can minimize the temptation to dip into these savings for non-emergencies.

If your budget feels too tight to accommodate an emergency fund, consider finding additional sources of income. Part-time jobs, internships, or freelance gigs can be excellent ways to bring in extra cash. The University of Arizona may offer job opportunities on campus that cater to student needs and schedules, so explore those options as well.

One effective strategy for ensuring regular contributions to your emergency fund is to automate your savings. Many banks allow you to set up automatic transfers from your checking account to your savings account on a regular basis—weekly or monthly. This way, you can save without having to think too much about it. Automating your savings can also help you manage your cash flow more effectively.

Just as it’s important to establish your fund, it’s equally important to maintain it as well. Review your emergency fund regularly—at least twice a year—to ensure that it still meets your needs. As your financial situation changes—whether due to graduation, a new job, or increased costs—adjust your fund to reflect new realities.

While an emergency fund is designed for unexpected expenses, it’s crucial to be discerning about what qualifies as an ‘emergency.’ Instead of relying on your fund for planned expenses or non-urgent financial obligations, save the fund for true emergencies—those unforeseen situations that could substantially impact your financial health or academic journey.

The University of Arizona offers a wealth of resources that can help students develop towards financial literacy. Consider attending workshops and seminars aimed at improving personal finances. These sessions often cover topics such as budgeting, debt management, and building an emergency fund. Engaging with these resources can enhance your understanding of effective financial practices.

Maintaining an emergency fund is one of the most proactive steps that University of Arizona students can take towards financial stability. It equips you to face unexpected challenges without added stress, allowing you to focus on your educational objectives. Remember that financial literacy is a continuous process. Stay informed, be disciplined, and embrace the lessons learned along your journey to financial independence.

In summary, by understanding what an emergency fund is, setting tangible goals, creating a budget, and learning to save consistently, University of Arizona students can master the practice of saving. It’s not just about having money put aside; it’s about empowering yourself to navigate the unpredictable nature of life and education. Start cultivating this habit today, because a stronger financial future begins with the fundamental step of establishing your emergency fund.