Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Hello friends! It’s that time of the year again when we take a step back and reevaluate our financial situations. As we dive into 2024, it’s crucial to consider effective personal finance tips that can help us navigate our finances throughout the year. Whether you’re looking to save more, invest wisely, or simply keep your finances in check, there are plenty of strategies you can adopt. Let’s explore some of the best personal finance tips for 2024 that can lead you towards a healthier financial future.

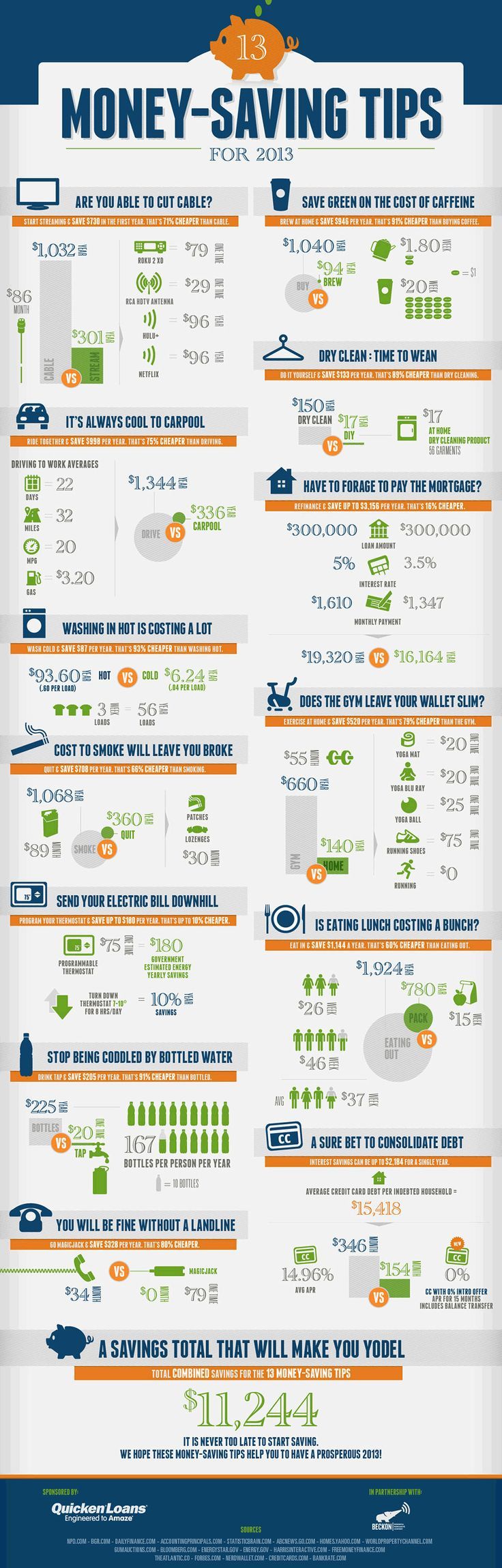

This image beautifully summarises the essence of our journey in mastering personal finance. As we embrace the new year, keeping a positive mindset about our financial goals can inspire us to take the necessary steps towards achieving them.

The very first step in any personal finance journey is to set clear financial goals. Understanding what you want to achieve by the end of 2024 will shape your financial decisions. Do you want to save for a vacation, buy a new home, or pay off debts? By identifying specific goals, you can create a roadmap that guides your financial actions. Whether it’s short-term goals such as saving for a new gadget or long-term ones like retirement planning, having clarity is key.

One of the most effective personal finance tips for 2024 is to create and stick to a budget. A budget provides you with a solid framework for managing your income and expenditures. Start by listing all your income sources and fixed expenses, then allocate funds to discretionary spending and savings. Utilize budgeting apps or spreadsheets—whichever method works best for you—to help track your finances. Remember, a budget isn’t meant to restrict you; rather, it’s a tool to empower you to make informed financial decisions.

One of the unexpected personal finance tips for 2024 involves establishing an emergency fund. Life can be unpredictable, and having a safety net can provide peace of mind. Aim to save at least 3-6 months’ worth of living expenses in a separate savings account. This fund should only be used for genuine emergencies, such as unexpected medical expenses or critical car repairs. Building this cushion will help you avoid going into debt when life throws curveballs your way.

Debt can be a heavy burden, but understanding it is essential to managing it effectively. This year, take the time to assess your debts—know the total amount you owe, the interest rates, and the repayment terms. Use this information to create a debt repayment plan. Whether you choose the snowball method, focusing on paying the smallest debts first, or the avalanche method, paying off high-interest debts first, make sure to stay committed to your plan. Many people have successfully navigated their way out of debt, and with the right personal finance tips for 2024, you can be one of them.

Investing is a crucial part of personal finance, and 2024 should be the year you build or diversify your investment portfolio. Take the time to educate yourself about different investment options such as stocks, bonds, mutual funds, and real estate. Consider your risk tolerance, and start small if you’re new to investing. Use a robo-advisor, or consult a financial advisor for personalized advice that matches your financial status and goals. Ultimately, let your money work for you!

Another often overlooked area in personal finance management is insurance. As we enter 2024, take the opportunity to review your health, home, auto, and life insurance policies. Ensure that you have adequate coverage and that you’re not paying too much in premiums. Shop around for better rates if necessary, and don’t hesitate to negotiate with your current providers. Protecting yourself and your loved ones financially is an essential part of sustainable personal finance practices.

Knowledge is power, especially when it comes to personal finance. Spend time in 2024 learning about personal finance topics through books, podcasts, and online courses. This education will empower you to make informed decisions regarding investments, savings, and budgeting. Don’t hesitate to ask questions or seek advice from knowledgeable individuals. The more you know, the more confident you’ll become in managing your finances.

It’s never too early to start planning for retirement! Even if retirement seems far away, taking steps now significantly impacts your future financial stability. Consider contributing to a retirement plan such as a 401(k) or IRA. If your employer offers a matching contribution, make sure to take full advantage of it—it’s free money! The earlier you start saving for retirement, the more your money can grow due to compound interest.

Like any goal, tracking your progress is essential. Regularly review your financial situation to see where you stand in terms of your goals, budget, and investments. Make adjustments as necessary to ensure you stay on track. Whether you do this monthly or quarterly, the key is to hold yourself accountable for your financial journey.

Lastly, working on building healthy financial habits can set you up for long-term success. Whether it’s avoiding impulse purchases, checking your bank account regularly, or seeking financial advice when needed, small but consistent changes can lead to significant results. Incorporate these personal finance tips for 2024 into your daily routine, and watch how they transform your financial health.

Taking control of your finances doesn’t have to be overwhelming. By adopting these personal finance tips for 2024, you can pave the way to a more secure financial future. Remember, every small step counts, and the journey begins with you. Embrace this year as an opportunity for growth, and soon you’ll see the positive impact of your efforts on your financial landscape.