Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Welcome to the exciting world of financial wellness! Today, we’re diving deep into the art of money management. If you’ve ever felt overwhelmed by your finances or wish you had a better grip on budgeting, you’re not alone. Tracking your expenses and saving money are vital skills, and one great tool to help with that is a money management journal. But before we get into the ins and outs of that, we have a special treat for you—stay tuned for a chance to earn a free gift by sharing your thoughts with us!

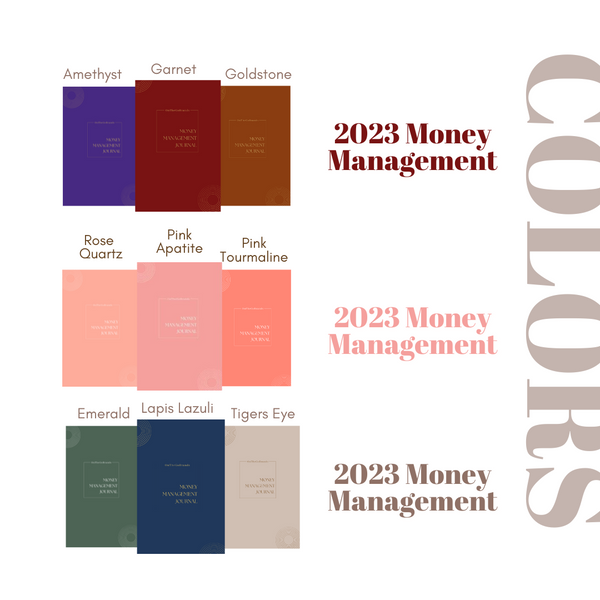

This colorful guide represents not only a resource but a commitment to better financial health. Let’s take a closer look at how integrating a money management journal into your routine can lead to significant improvements in your financial outlook.

A money management journal is more than just a notebook; it’s your financial roadmap. It provides clear visibility into your spending habits and helps identify areas for improvement. Here are several key reasons why every individual should consider maintaining one:

So how do you start? It’s simpler than you might think. Here’s a step-by-step guide to kick off your money management journey:

Your money management journal can be a physical notebook or a digital app. Choose the format that resonates with you. What’s important is that it’s something you’ll use consistently.

A well-organized journal can make tracking easier. Consider setting up sections for:

Incorporate journaling into your daily routine. Spend a few minutes at the end of each day logging your expenditures and reflecting on your financial goals.

Now that you have your journal set up, how can you get the most out of it? Here are some practical tips:

Make your entries more engaging by using charts or graphs. Visual representation of your finances can make trends more apparent. Plus, it makes the process more enjoyable!

Set aside time each week or month to review your journal. Analyze what worked and what didn’t, and adjust your strategies accordingly. Reflecting on your progress is crucial for maintaining momentum.

Don’t forget to celebrate your milestones, no matter how small. If you manage to save a certain amount or stick to your budget for a month, reward yourself! Acknowledging progress boosts motivation.

Scholarly reading can accompany your journaling journey. Look for books, blogs, and courses dedicated to financial health. The more you learn, the better equipped you’ll be to manage your money effectively.

Consider joining online forums or local groups focused on personal finance. Sharing experiences with others can provide you with tips and tricks that you might not have considered. Plus, it fosters a sense of community.

As you embark on this journey with your money management journal, we’d love to hear your thoughts! Comeback and leave us a review for a chance to receive a free gift. Your insights are invaluable to us and can help others in their financial journey as well.

Incorporating a money management journal into your life can pave the way toward greater financial clarity and freedom. Remember, every great journey begins with a single step, and your financial wellness is no exception. Start small, stay consistent, and watch your relationship with money transform.

There’s truly no better time than now to get started. Join the ranks of individuals reclaiming their financial power through effective money management practices. And remember—you’re not alone! By sharing your experiences and insights, you enrich not only your path but also the paths of others navigating similar journeys.

Ready to take control? Grab your journal today, and let’s embark on this adventure toward financial success together!