Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In today’s financial landscape, the importance of maintaining a clear and organized record of your finances cannot be overstated. A personal finance ledger serves as an invaluable tool that helps individuals keep track of their income, expenses, and savings goals. By utilizing a well-structured ledger, you empower yourself to make informed financial decisions, ultimately leading to improved financial stability and peace of mind.

At its core, a personal finance ledger is a systematic approach to documenting every financial transaction you engage in. This tool is especially beneficial to those who wish to manage their budgets effectively, allowing them to visualize where their money is coming from and where it is going. Each entry in the ledger represents a snapshot of your financial health, enabling you to track progress toward your financial goals.

A personal finance ledger serves several key functions. Firstly, it enhances your awareness of spending habits, identifying areas where you might be overspending. Secondly, it can assist in budgeting, providing insights into income versus expenses. Finally, it can facilitate savings by setting specific targets, thereby encouraging you to save more effectively.

To get started with your personal finance ledger, consider the following steps that can guide you in setting it up efficiently:

Once your personal finance ledger is set up, it’s crucial to establish a routine for maintaining it. Consistency is key; consider dedicating specific times during the week or month to update your records. By doing so, tracking your finances will become a habit that positively impacts your broader financial strategy.

Utilizing a personal finance ledger can significantly enhance your ability to visualize your financial situation. A well-maintained ledger allows you to generate reports or summaries that reflect your spending patterns and savings progress. This visibility can motivate you to adhere to your budget and financial goals.

While traditional ledgers have their merits, digital personal finance ledgers offer numerous advantages. Tools like budgeting apps or spreadsheet software streamline the process of tracking, categorizing, and analyzing your financial transactions. They often come with features that automate calculations, generate graphs, and provide reminders, making it easier than ever to maintain financial discipline.

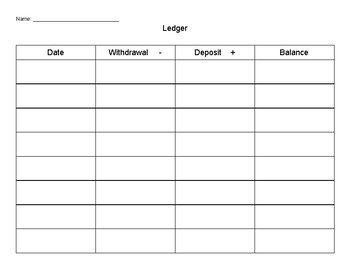

In the image above, you will see a sample of a personal finance ledger. This example highlights the importance of categorizing your expenses and income for clearer oversight. By following such a structured approach, you can monitor your financial health more accurately.

There are several mistakes that individuals commonly make when it comes to maintaining a personal finance ledger:

To effectively maintain your personal finance ledger, consider implementing some tips to overcome common barriers:

Having a personal finance ledger is not just about keeping records; it’s about helping you achieve your financial goals. These may include saving for a home, paying off debt, or building an emergency fund. By keeping your financial objectives in mind, you can tailor your spending and saving habits accordingly.

Consider adopting the SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound) when defining your financial goals. For example, instead of saying, “I want to save money,” specify, “I want to save $5,000 for an emergency fund in the next 15 months.” This clarity makes it easier to track your progress in your personal finance ledger.

Engaging in accountability can boost your commitment to maintaining your personal finance ledger. Consider sharing your financial goals with a friend or family member who can keep you on track or join a financial management group where you and others can share insights and strategies.

As you progress on your financial journey and meet specific objectives, ensure that you take the time to celebrate these milestones. Acknowledging successes can enhance your motivation and reinforce positive financial habits.

The world of finance is ever-changing, and staying informed is vital. Regularly review your personal finance ledger not only for accuracy but also to recognize trends in your financial behaviors. This continual reflection enables you to adjust your strategies as necessary, ensuring you remain aligned with your financial goals.

Consider investing time in learning more about personal finance through books, podcasts, online courses, or seminars. The more educated you become, the better equipped you’ll be to make informed decisions and optimize your personal finance ledger for maximum effectiveness.

A personal finance ledger is a powerful tool that can help you take charge of your financial situation. By understanding its role, maintaining it regularly, and utilizing its insights, you can improve your overall financial health. Whether you choose traditional methods or digital tools, the key is to find a system that works for you and to remain consistent in your efforts. Start your journey today toward better financial management and watch how it transforms your financial goals into reality.