Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In today’s fast-paced world, managing personal finance can often feel overwhelming. Fortunately, numerous software solutions have emerged to help individuals take charge of their financial future. Whether you’re looking to budget better, track expenses, or plan for retirement, the best software for managing personal finance can streamline these processes, making it easier to achieve your financial goals. Let’s delve into some key features and benefits of the top contenders in this field.

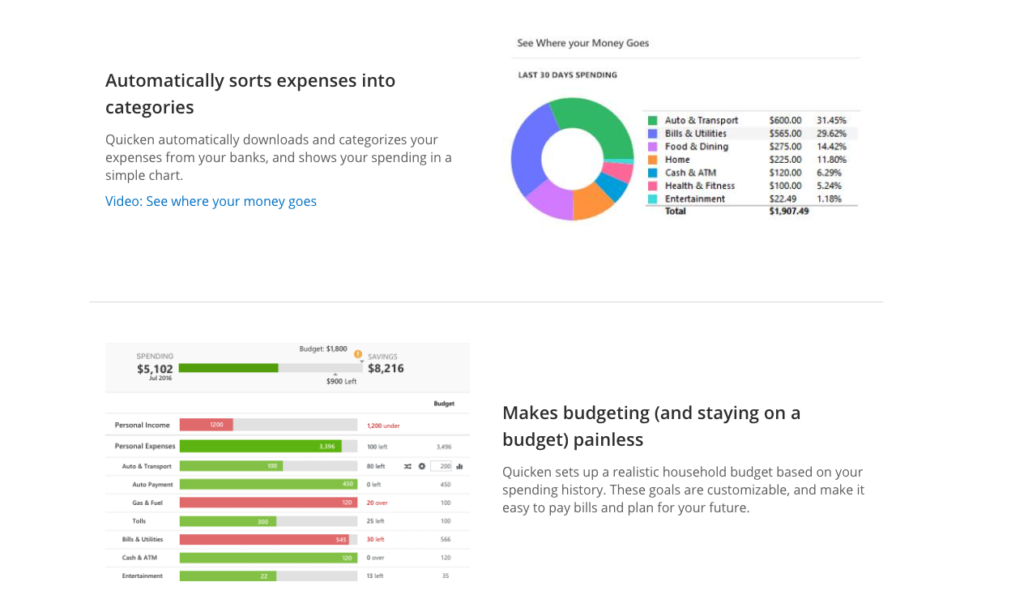

As you explore the best software for managing personal finance, it’s essential to understand what features make a platform stand out. Generally, effective personal finance software provides budgeting tools, investment tracking, and debt management features. The right choice will depend on your specific needs, whether you’re a young professional just starting to build your financial foundation or someone who’s looking to manage retirement funds.

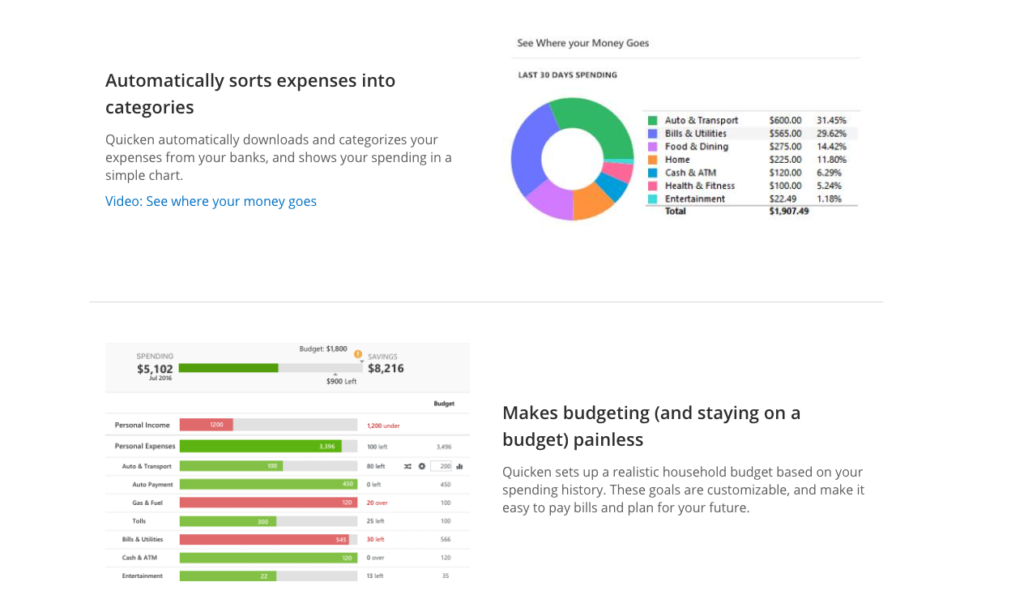

Effective visualizations in personal finance software can clarify where your money is going and where you can save. A graphical representation of your income, expenses, debts, and savings can inspire actionable decisions and improvements.

When selecting software, certain features can significantly enhance your experience. Here are some of the must-have elements:

Understanding your finances is crucial to achieving both short-term and long-term goals. With one of the best software for managing personal finance, you can:

Now that we’ve established why using the best software for managing personal finance is essential, let’s review some popular options:

Mint is renowned for its ability to sync with bank accounts, offering real-time updates on your transactions. Its robust budgeting tools allow users to create and customize budgets tailored to their spending habits.

YNAB takes a proactive approach to budgeting, encouraging users to allocate every dollar to a specific purpose. This method helps users avoid overspending and promotes more effective money management.

Along with budgeting tools, Personal Capital provides in-depth investment tracking and retirement planning features. Users can monitor their net worth in real time, enabling careful planning for the future.

Quicken, a longstanding player in the personal finance space, offers diverse features from budgeting to investment tracking. Its ability to connect to various financial institutions makes it a flexible option for many users.

Every individual’s financial situation is unique, which is why finding the best software for managing personal finance compatible with your lifestyle is vital. Consider your financial goals, preferred tools, and whether you need help with budgeting, saving, or investing.

Most software allows for a degree of customization, enabling you to adapt features to your preferences. If you’re someone who prefers visual data representation, look for software that excels in this area. Conversely, if you’re more analytical, choose a solution that provides detailed analytics.

One of the more beneficial features offered by top-tier personal finance software is the ability to set up alerts and notifications. These alerts can notify you when bills are due or if you’ve exceeded your budget in certain categories.

Ultimately, the best software for managing personal finance is a vital tool that can help you develop better money habits, stay informed about your finances, and reach your long-term financial goals. As you navigate your financial journey, employing a reliable platform will empower you to make savvy decisions that lead to financial wellness and success.

Invest time in exploring the features of different software options, and don’t hesitate to try a few to find the one that resonates with you. Achieving financial literacy and stability is an ongoing journey, and with the right tools, you can take proactive steps toward a secure financial future.