Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Welcome, folks! Today, we’re diving into the enthralling world of NRE (Non Resident External) accounts, where your money gets to enjoy the best of both worlds—like a vacation with boat drinks and tropical sunsets, all without leaving your bank! Let’s unravel the whims and wonders of NRE accounts and find out why they are the secret ingredient to financial success for non-residents wanting to invest in mutual funds.

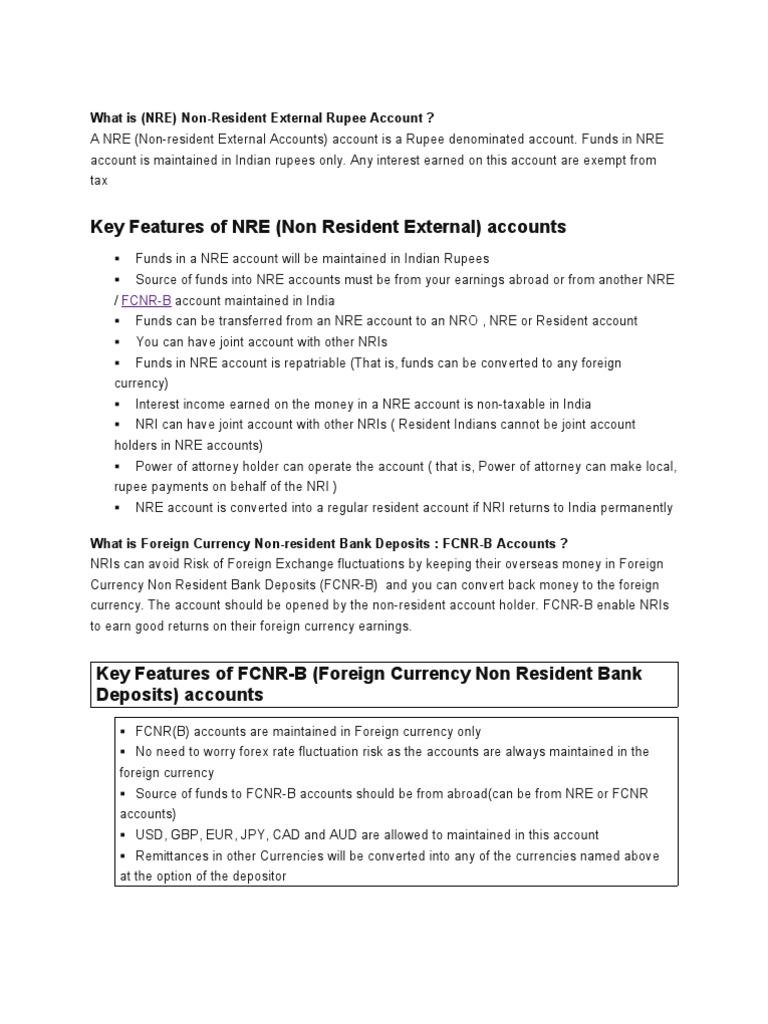

First things first, let’s demystify what an NRE account really is. Picture this: You’re living it up abroad, sipping margaritas on a sun-drenched beach. But wait! Your money is still back home, just chilling in your INR (Indian Rupees) account, right? That’s where the NRE account swoops in like a superhero! It allows NRIs (Non-Resident Indians) to hold and manage their foreign earnings in Indian currency. Pretty neat, eh? But wait, there’s more! It opens up fantastic avenues like investing in mutual funds!

Okay, folks, let’s talk benefits! Just like a good pair of hiking shoes for your adventurous soul, an NRE account equips you with plenty of advantages:

Now, let’s spill the beans on why investing in mutual funds through an NRE account might just be the best decision you make today—besides that second slice of cake, of course! Mutual funds allow you to pool your money with other investors; think of it as a big potluck where everyone brings their favorite dish (or in this case, cash) to share. But here’s the kicker: as an NRI, your entry ticket into this potluck is your NRE account! Let’s break it down:

Investing through an NRE account comes with a buffet of juicy options! From equities to debt funds—pick your poison. Not only can you harness the power of the Indian economy, but you also get to diversify your portfolio faster than a squirrel on caffeine! And the cherry on top? Many mutual funds give out dividends, which can be transported back to your NRE account without a hitch.

Check out this amazing resource for more info!

Now that we’ve whetted your appetite for mutual funds, let’s dive into some specifics. There are predominantly two types of mutual funds you can invest in through your NRE account: equity funds and hybrid funds. Equity funds are like that daring friend who encourages you to try skydiving—you could go up or you could plummet down! Conversely, hybrid funds are more moderate, a bit like a chill day at the beach. Both are experiences you want to engage in, right?

Okay, let’s discuss how to unlock the gates to this financial kingdom!

Is it clear yet? The NRE account is your golden ticket to experiencing the best of both worlds. Whether you want to indulge in riskier equity investments or take it easy with balanced hybrid funds, it’s all within reach. You’ll be sipping on coconut water while birds sing a cheerful tune about how easy it is to reap tax-free dividends and watch your money grow while you are on that enchanting beach vacation.

Let’s hear about some superheroes among us, shall we? Meet Raj, who took the plunge into mutual funds through his NRE account. He started investing small amounts initially, and over time, he grew his investments like a well-nourished chia pet. Today, he’s not just swimming in rupees; he’s zipping around in a fancy sports car, all thanks to the lucrative market opportunities that came with his NRE account. Talk about a glow-up!

And then there’s Priya, who, encouraged by her friend Raj, decided to give mutual funds a shot too. She researched, selected the right funds, and let her investment journey commence! Now, she throws lavish tea parties for her friends, boasting about her mutual fund successes. Who knew being smart with money could lead to such victories?

So there you have it! With an NRE account in your financial toolkit, investing in mutual funds may just become the fun and fruitful experience you’ve been searching for. Whether you dream of travel, new experiences, or just kicking back with comfortable wealth, your NRE account is the way to go! Seriously, folks, it’s time to put those dollars to work and let them swing their way into mutual funds.

So the next time someone asks, “What’s your secret?” Just wink and say, “It’s an NRE account that has me investing in mutual funds!”