Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

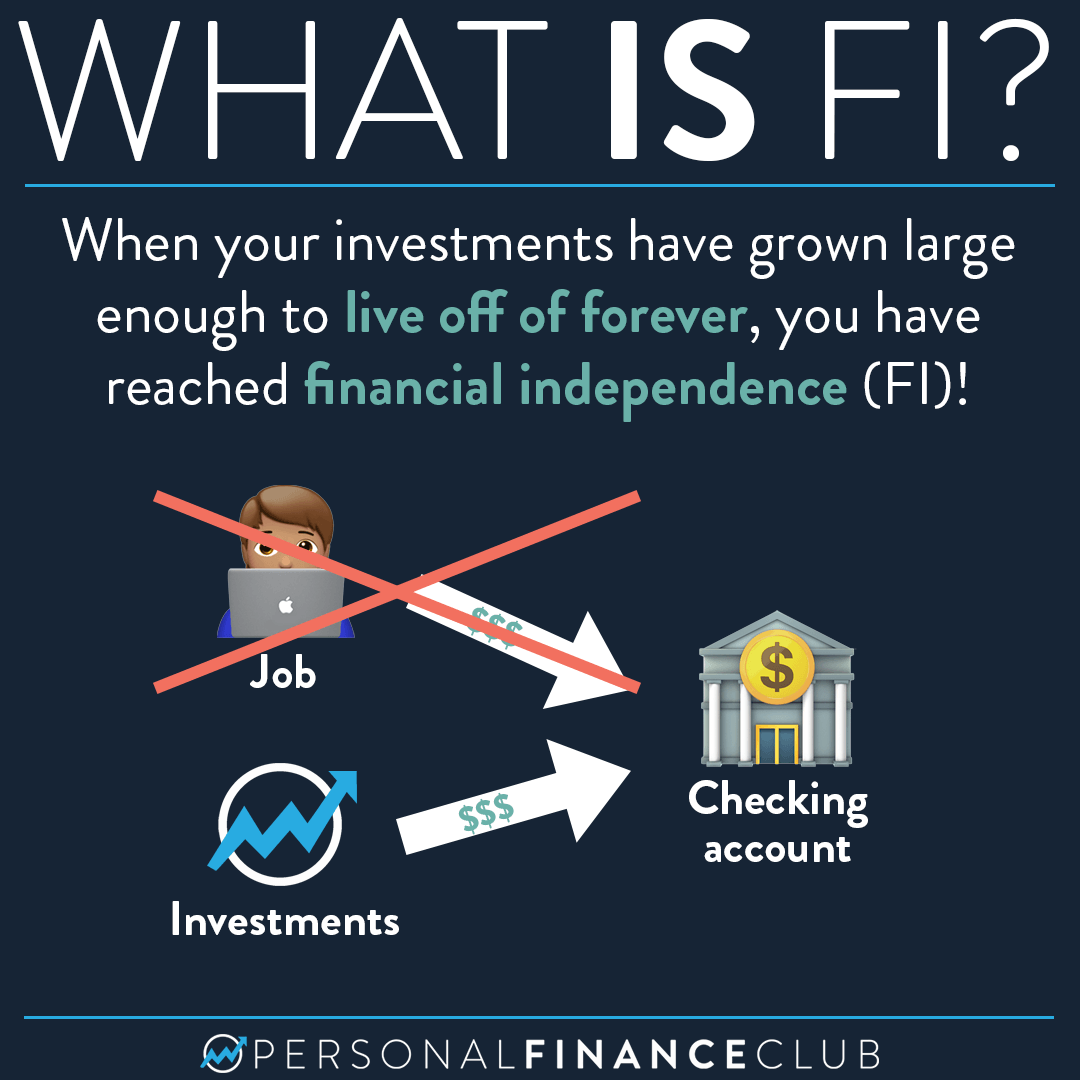

Ah, financial independence! The elusive goal that makes you feel like a grown-up adult with your life together. You may wonder, “What is financial independence?” Is it simply having enough money to buy your dream yacht? Or is it really about having the freedom to do whatever you want without stressing over that next paycheck? Let’s dive into this financial pond and fish out the answers, shall we?

At its core, financial independence is the state of having enough personal wealth to live without having to actively work for basic necessities. Yes, you read that right! The dream of sipping piña coladas at noon while your money works tirelessly for you is indeed possible. But before you start shopping for that floating tiki bar, you need to understand what financial independence is all about.

Now that we’ve got your attention with a picture that’s as refreshing as an iced coffee on a hot day, let’s dig deeper.

Imagine a world where your biggest financial concern isn’t which credit card to pay off first, but rather which beach to go to next. Sounds dreamy, right? Financial independence allows you to escape the daily grind and gives you the freedom to chase after what you genuinely enjoy. But let’s break this down further because finances shouldn’t be fuzzy. After all, clarity is key when it comes to determining what financial independence is!

To clearly understand financial independence, think of it as a financial safety net large enough to catch you from life’s unexpected falls. It’s that beautiful cushion of cash that means you don’t have to rush back to work because your toaster started sparking and accidentally incinerated a bag of frozen pizza. Yes, you can handle those modern dilemmas like a champ! So, what does this all entail?

Financial independence isn’t as straightforward as simply possessing a large bank account. Here are the pillars that will guide you on your path:

Now let’s address some common myths about financial independence:

Wrong! While having a hefty bank account does help, financial independence isn’t exclusively for the millionaires of the world. It’s about managing your money effectively and prioritizing your spending. Who needs a yacht when you can have a fabulous inflatable pool in your backyard?

Hold your horses! While it does mean you won’t have to clock in for that monotonous 9-5 grind, it doesn’t necessarily mean you can never work again. Many people choose to pursue passionate projects or part-time gigs that they love. Think of it as flipping your career on its head, not casting it aside entirely.

Alright, here comes the part where action meets strategy! If you’re ready to join the ranks of the financially independent, it’s time to create a plan:

Like any good plan, flexibility is key. Life happens. Your goals might change, or unforeseen expenses may pop up like pesky weeds in your garden. Adjust as necessary, but don’t lose sight of what financial independence means to you!

As you adjust your sails and navigate the waters of financial independence, don’t forget to celebrate! Here’s what it can look like:

Financial independence is a journey filled with twists and turns—much like a roller coaster. There will be highs, lows, and some loop-de-loops. However, with the right plans and mindset, you can reach that finish line where the margaritas and endless beach days await.

So, have fun with this adventure! Embrace the ups and downs, chase those financial goals, and before you know it, you’ll be saying, “What is financial independence?” well after you’ve achieved it. Now go get started! The financially independent life is just around the corner.