Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

When considering a home improvement loan, understanding your average credit score is crucial. If you’re looking to refresh your living space, whether it’s a quaint kitchen remodel or a bigger renovation job, having a solid grasp on what lenders look for in a credit score can make a world of difference in navigating the loan process. In this article, we’ll delve deep into the specifics of home improvement loans and the significance of the average credit score.

Home improvement loans can offer homeowners the chance to upgrade their properties, adding value, comfort, and functionality. However, when applying for these loans, lenders will play close attention to your average credit score. A strong credit score can unlock competitive interest rates and better loan terms, while a lower score might limit your options. Let’s explore how the average credit score can impact your ability to secure a home improvement loan.

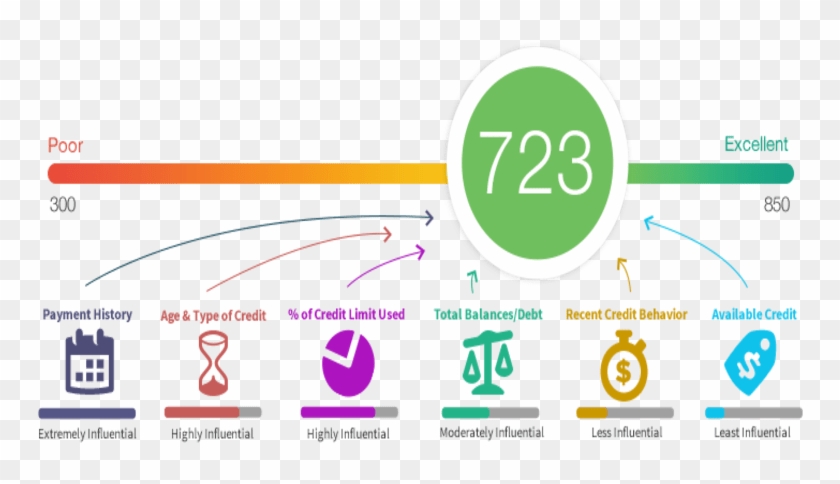

As shown in the image above, understanding credit scores is key to navigating the loan process.

Your average credit score plays a pivotal role when seeking a home improvement loan. Generally, a higher credit score indicates a lower risk to lenders. This is why it’s essential to understand what constitutes a good average credit score and how it affects your loan application.

Typically, credit scores are categorized as follows:

Ideally, to secure favorable terms on your home improvement loan, you want to aim for at least a good credit score of 680 or higher. Here’s why:

Many lenders often use the average credit score to assess whether to approve a loan application. If your average credit score is at least 700, chances are much higher that you will qualify for better loan terms. On the other hand, if you fall below this threshold, you may face higher interest rates or even denial of your application.

It’s important to remember that even if you have a lower average credit score, there are options available. Some lenders might specialize in offering home improvement loans to those with less-than-perfect credit credentials. However, these loans may come with heftier fees and interest rates to compensate for the additional risk taken by the lender.

Before you jump into applying for a home improvement loan, consider taking steps to improve your average credit score. Here are some actionable tips:

Low-interest rates can significantly reduce the overall amount you pay on a loan, which is why securing a desirable average credit score becomes imperative. When you have a higher average credit score, lenders will often offer lower interest rates as a reward for your creditworthiness. Over time, this can translate into substantial savings.

For example, a difference of just 1% on an interest rate can result in considerable savings on a 10-year loan for a home improvement project. Always calculate the total cost of the loan over its term to understand how your credit score impacts the financial aspect of your improvement plans.

If, after evaluating your finances, you find that your average credit score isn’t where you’d like it to be, don’t worry! There are still pathways available to secure a home improvement loan. Here are a few alternatives you might consider:

Once you receive an offer for a home improvement loan, take the time to read through the terms and conditions carefully. Even with a favorable average credit score, it’s vital to ensure that you understand the full implications of the loan you’re considering. Pay attention to the fine print, which can have hidden fees or penalties for early repayment.

By being informed about how a home improvement loan operates in tandem with your average credit score, you’ll make better financial decisions tailored to your needs.

In conclusion, the relationship between home improvement loans and average credit scores is one that every homeowner must navigate. Whether you are looking to obtain a loan now or in the future, maintaining a healthy credit score can save you money and stress. Remember, working on improving your credit score can open doors to numerous options in your home improvement endeavors. By being proactive and informed, you’ll be much better positioned to take on those exciting renovations and enhancements to your home.

So take a step today—check your score, learn how to improve it, and prepare to launch into your next home project with confidence. Happy home improving!