Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In an ever-evolving economic landscape, mastering the art of personal finance management is essential for achieving financial stability and independence. Whether you are just starting your career or are looking to enhance your existing financial knowledge, understanding how to manage finances effectively can significantly impact your quality of life. This article will delve into various strategies and tips for those seeking to navigate their financial journey with confidence.

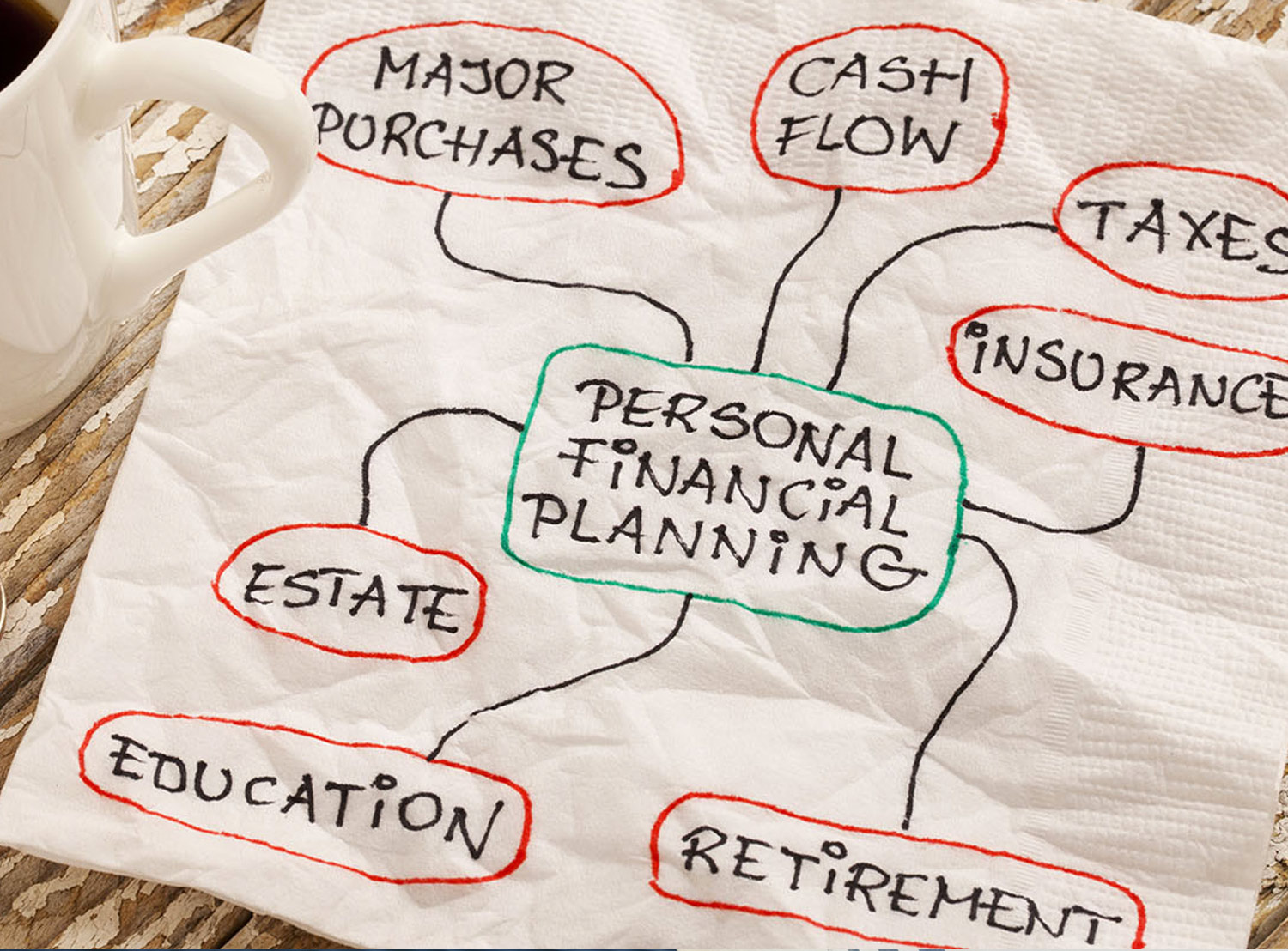

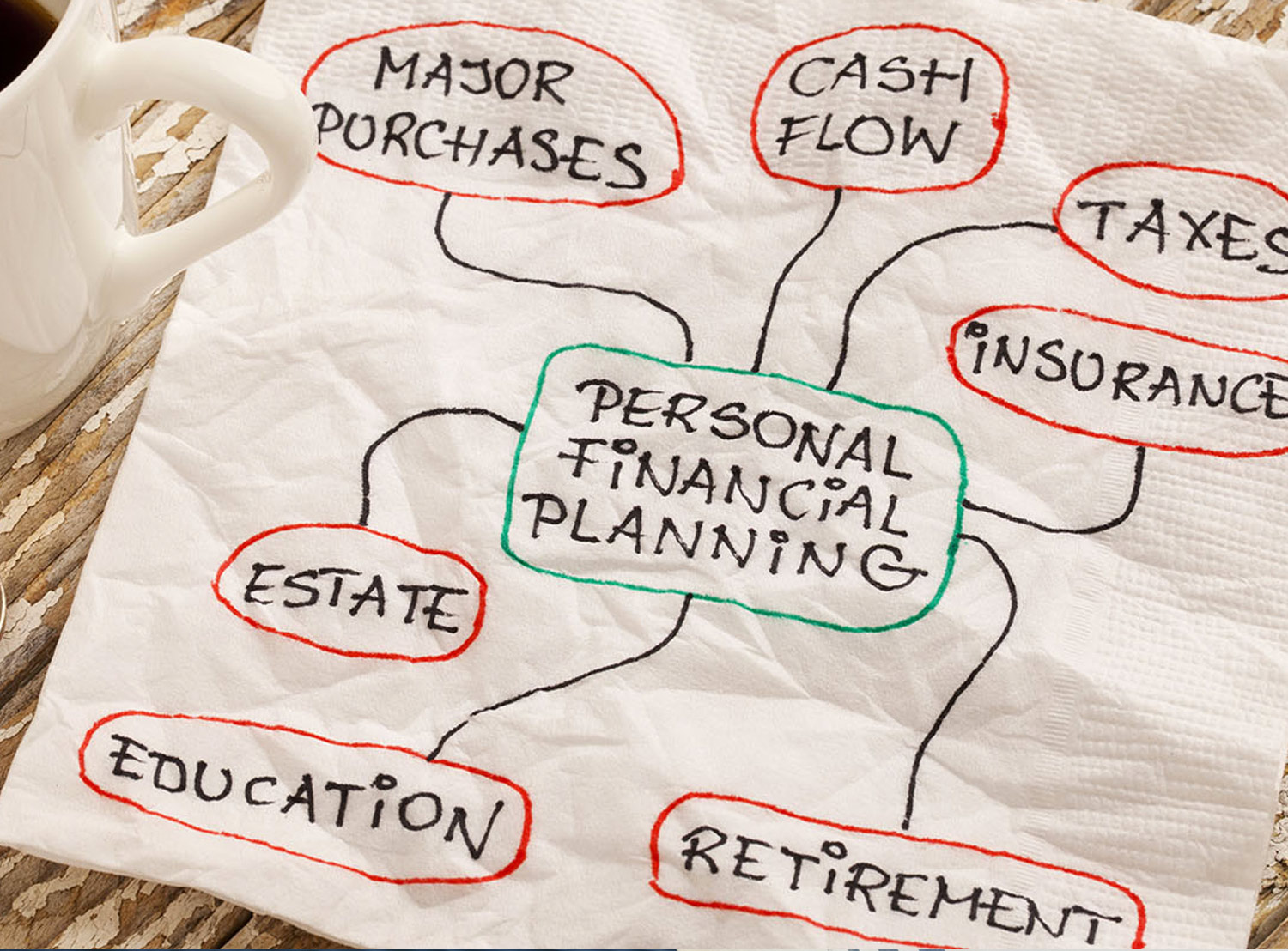

To embark on the path of financial success, it is crucial to first comprehend what effective financial management entails. Learning how to manage finances effectively involves a combination of budgeting, investing, saving, and debt management. Each of these elements plays a vital role in forming a robust financial foundation.

One of the fundamental steps in how to manage finances effectively is setting up a budget. A budget serves as a roadmap for your financial activities, guiding where your money goes each month. Begin by surveying your income sources and tracking your expenses to identify patterns. Here are some steps to create a practical budget:

After learning how to manage finances effectively through budgeting, the next step is to prioritize savings. Establishing an emergency fund should be your first line of defense against unforeseen circumstances, such as job loss or unexpected medical expenses. Aim to save three to six months’ worth of living expenses in a dedicated savings account.

Once you have a stable emergency fund, investing becomes a key component of how to manage finances effectively. Investing allows your money to grow over time, outpacing inflation and increasing your wealth. Here are some investment avenues you might consider:

Understanding how to manage finances effectively also involves addressing debt head-on. Carrying high-interest debt can severely impede your financial progress. Here are strategies to manage and reduce debt:

Implementing financial principles into your daily life can take time and commitment. Here are practical tips on how to manage finances effectively on a day-to-day basis:

Moreover, surrounding yourself with financially savvy individuals can be beneficial. Join community groups or forums where you can share insights like how to manage finances effectively, learn from others’ experiences, and stimulate your motivation.

Continuous learning plays a pivotal role in how to manage finances effectively. Stay updated on financial news, economic trends, and changes in policies that could impact your financial landscape. Reading books, attending workshops, or following reputable financial blogs are effective ways to enhance your financial literacy.

Consulting with a financial advisor can provide personalized strategies tailored to your financial situation. Whether you need help with investment planning or debt management, a professional can offer insights that reinforce how to manage finances effectively.

In your journey to mastering personal finance, maintaining discipline is crucial. Avoiding lifestyle inflation, where your expenses rise as your income increases, can help you save more. Continually revisit your financial goals and remind yourself why you started your financial journey in the first place.

Lastly, make it a habit to review your finances periodically. Reflect on your spending habits, savings, and investments to measure progress toward your financial goals. This review can reveal areas for improvement and adjustments needed to stay on track with how to manage finances effectively.

In summary, learning how to manage finances effectively is a lifelong journey that takes time, dedication, and proactive steps. Start with creating a solid budget, prioritize savings, invest wisely, and manage debt strategically. Stay informed, seek guidance when needed, and remain disciplined in your financial practices. With these practices in place, you can secure a bright financial future and achieve your monetary goals.