Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

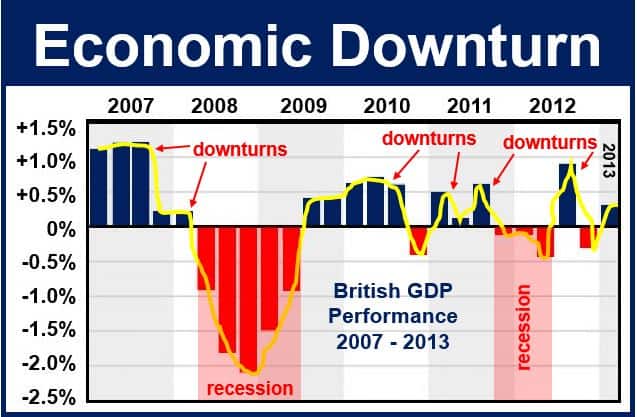

In the world of finance and economics, understanding economic downturns is crucial for professionals across various sectors. Economic downturns can have profound effects on financial stability, employment rates, and consumer spending. The exploration of financial management during such periods is essential for businesses to navigate challenges effectively. Below are detailed insights into economic downturns, along with visual representations that enhance the understanding of this critical phenomenon.

This image encapsulates the theme of the presentation regarding economic downturns and financial management. During a recession, financial management becomes paramount for businesses aiming to maintain profitability and liquidity. Professionals must develop strategies that safeguard against cash flow issues while focusing on long-term sustainability. The integration of financial forecasting and budgeting is critical during such times, as they assist organizations in assessing their financial health and making informed decisions.

Economic downturns are defined as a period of negative economic growth, often marked by declines in consumer spending, increased unemployment rates, and a reduction in production and investment. Healthcare, technology, and various other sectors can suffer from the ramifications of such downturns. Understanding the causative factors—be it market fluctuations, global crises, or poor fiscal policies—is essential for professionals aiming to mitigate risks and adapt to changing economic landscapes.

In-depth analysis reveals that the response to an economic downturn should involve a multidimensional approach. Economic resilience can be developed through diversified investments, strong risk management practices, and the promotion of innovation. Businesses that can pivot and adopt agility in their operations are more likely to withstand economic shocks and emerge stronger on the other side.

Furthermore, during economic downturns, consumer behavior tends to shift. Individuals may prioritize essential purchases, leading to significant changes in market demand. Professionals must keenly observe these trends to make necessary adjustments in their business models and marketing strategies. Data analytics and market research play a pivotal role in understanding shifting consumer preferences and behaviors during such periods.

One key takeaway is the importance of effective communication during economic downturns. Transparency and clear messaging can foster trust and loyalty among customers, employees, and stakeholders. Companies should aim to engage in open dialogues regarding potential challenges and the measures being undertaken to address them. This not only helps in maintaining morale within the organization but also assures customers of commitment to quality and service.

Moreover, the importance of financial management practices cannot be overstated. Effective cash flow management, cost control mechanisms, and strategic investments become critical at this juncture. Professionals must deploy comprehensive risk assessments and develop a robust financial strategy to navigate the turbulent waters of an economic downturn. The collaboration between different departments—finance, operations, marketing, and human resources—is pivotal for formulating a united response to the challenges faced.

As experts delve deeper into the realm of economic downturns, the significance of government policies and support programs also emerges as a crucial area of focus. Fiscal stimulus, tax relief, and support for small businesses can collectively contribute to the salvaging of an economy during downturns. Professionals in finance and economics must actively pursue collaborations with policymakers to advocate for measures that protect both businesses and jobs. Strong partnerships with local governments and economic development agencies can lead to constructive solutions that promote recovery and resilience.

In summary, economic downturns are inevitable phases in the economic cycle, characterized by various challenges that necessitate a strategic response from professionals across industries. The analysis of downturns coupled with effective financial management and the readiness to adapt to changing environments can make a significant difference. Such preparedness can ultimately drive sustainable growth and success, illuminating the path for enduring stability in the face of uncertainty. Through continuous learning, proactive decision-making, and a dedication to innovation, professionals can turn challenges into opportunities for growth even during times of economic adversity.

In a rapidly changing global economy, it is imperative for professionals to stay informed about the implications of economic downturns. Armed with knowledge and equipped with strategic tools, it is possible to manage risks and harness potential growth avenues. By fostering a culture of collaboration, transparent communication, and data-driven decision-making, organizations can bolster their resilience against economic challenges and pave the way toward recovery and enhanced performance.