Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

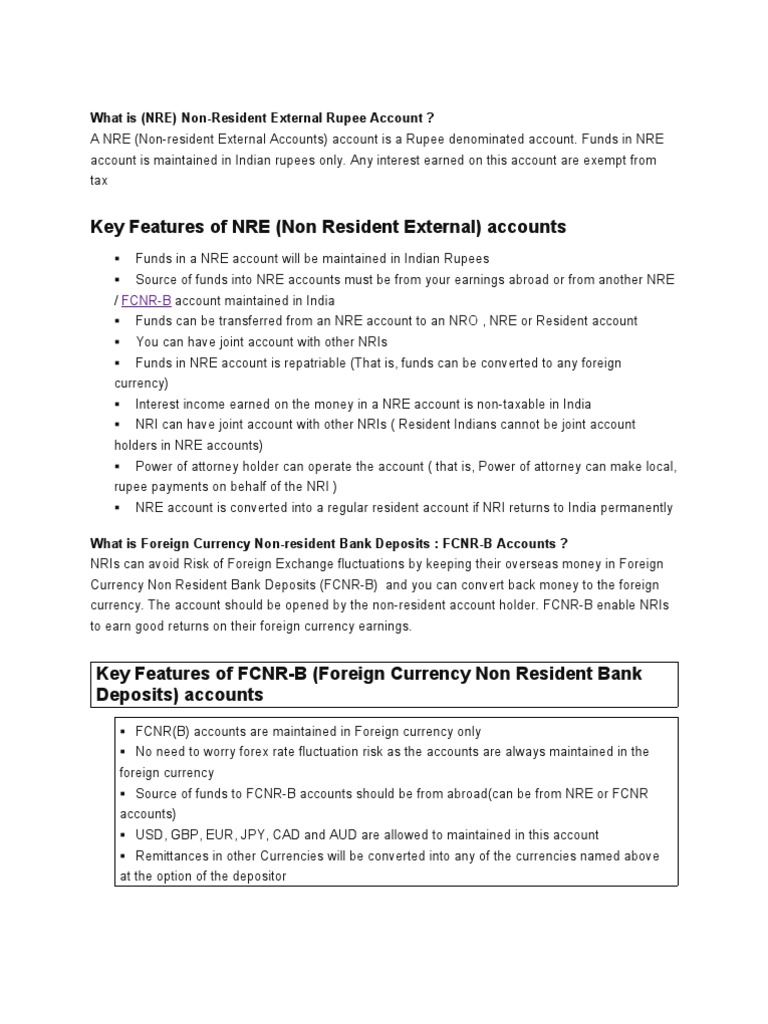

NRE (Non-Resident External) Accounts serve as a vital financial instrument for non-resident Indians (NRIs) looking to manage their income earned outside India. It allows for seamless transfer of foreign earnings to Indian banks while ensuring that the funds are repatriable. In this article, we will explore various investment options for NRE accounts, focusing on the flexibility and benefits they offer to NRIs. Throughout the discussion, we will highlight the key features and specifics that make these accounts an attractive choice for investment.

NRE accounts enable NRIs to explore several investment options that can help grow their wealth while ensuring compliance with regulatory requirements. With these accounts, individuals can easily channel funds into various avenues, providing both security and high returns. Let’s delve into the prominent investment options available for NRE account holders.

One of the most popular investment options for NRE account holders is fixed deposits (FDs). Financial institutions in India offer attractive interest rates on FDs for NRE accounts compared to regular resident accounts. The income generated from these deposits is free from Indian taxes, making them an optimal choice for NRIs looking to grow their capital securely.

Fixed deposits come with several benefits. They are considered low-risk investments, ensuring a degree of security for your capital. Furthermore, many banks offer flexible tenure options ranging from a few months to several years, allowing individuals to align their investments with their financial goals. The option of premature withdrawal adds to their liquidity, making FDs a convenient choice among investment options for NRE accounts.

For NRIs seeking to diversify their investment portfolio, mutual funds present an attractive avenue. Mutual funds pool resources from multiple investors to invest in a range of securities such as equities, debt, and other financial instruments. NRE account holders can easily invest in Systematic Investment Plans (SIPs) or lumpsum transactions to benefit from professional fund management.

Selecting the right mutual fund is critical to maximizing returns. NRIs should consider their risk tolerance, investment horizon, and financial goals before opting for a mutual fund scheme. With many funds focusing on specific sectors or asset classes, investors have a plethora of options available at their disposal.

While fixed deposits and mutual funds are commonly chosen, NRE account holders also have access to alternative investment options that can enhance their portfolio further. These options tend to come with varying levels of risk and liquidity.

Investing in real estate can offer substantial returns over the long term. Many NRIs choose to purchase property in India as an investment strategy. Not only does this provide a tangible asset, but it also allows for rental income, which can further enhance the cash flow back into the NRE account.

When investing in real estate through an NRE account, it is essential to be aware of the regulations governing property purchases by NRIs. Additionally, market trends and location play critical roles in determining the investment’s potential return. Collaborating with reliable real estate agents can facilitate smoother transactions and informed decisions.

The stock market offers one of the most lucrative investment options for NRE account holders but comes with its share of risks. NRIs can invest in stocks via their NRE accounts, giving them the ability to participate in the growth potential of the Indian economy. However, due diligence and a solid understanding of market dynamics are crucial for successful stock investments.

Investors should identify sectors that align with their growth expectations and evaluate the performance of individual stocks before making investments. Numerous research reports and advisory services are available to assist NRIs in making informed decisions. Furthermore, it is vital to diversify across various sectors to manage risk effectively.

When it comes to comparing the returns on different investment options for NRE accounts, each investment vehicle has its nuances. Understanding these can aid NRIs in optimizing their financial strategies. Below we juxtapose several options:

Diversifying one’s investment portfolio is crucial in mitigating risks and enhancing returns. By investing across multiple asset classes, NRE account holders are less vulnerable to market fluctuations. An effective strategy may involve blending fixed deposits, mutual funds, and equity stocks to achieve a balanced portfolio that meets individual financial objectives.

In summary, NRE accounts offer a wealth of investment options for NRIs looking to manage and grow their finances while residing abroad. From fixed deposits to stocks, the variety ensures that individuals can tailor their investments according to their financial goals, risk tolerance, and market conditions. Embracing these investment options for NRE accounts effectively can lead to substantial wealth accumulation while leveraging the benefits of India’s growing economy.

This visual representation further illustrates the diverse investment options available, providing a clearer understanding of how NRIs can strategically position themselves in the financial landscape.

Ultimately, NRIs aiming to leverage their NRE accounts for investment should consider consulting financial advisors and staying informed about market trends. Strategically managing investments can yield significant long-term benefits, leading to a financially sound future.