Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Managing personal finance is a crucial component of achieving financial stability and success in life. For students pursuing their Bachelor of Business Administration (BBA), having a solid grasp of personal finance management is not just beneficial; it’s essential. Whether you’re planning your budget, saving for future needs, or investing wisely, understanding the fundamentals of personal finance can set you up for a prosperous future. In this guide, we will delve deeply into the essential notes that help business students navigate the complexities of managing personal finance.

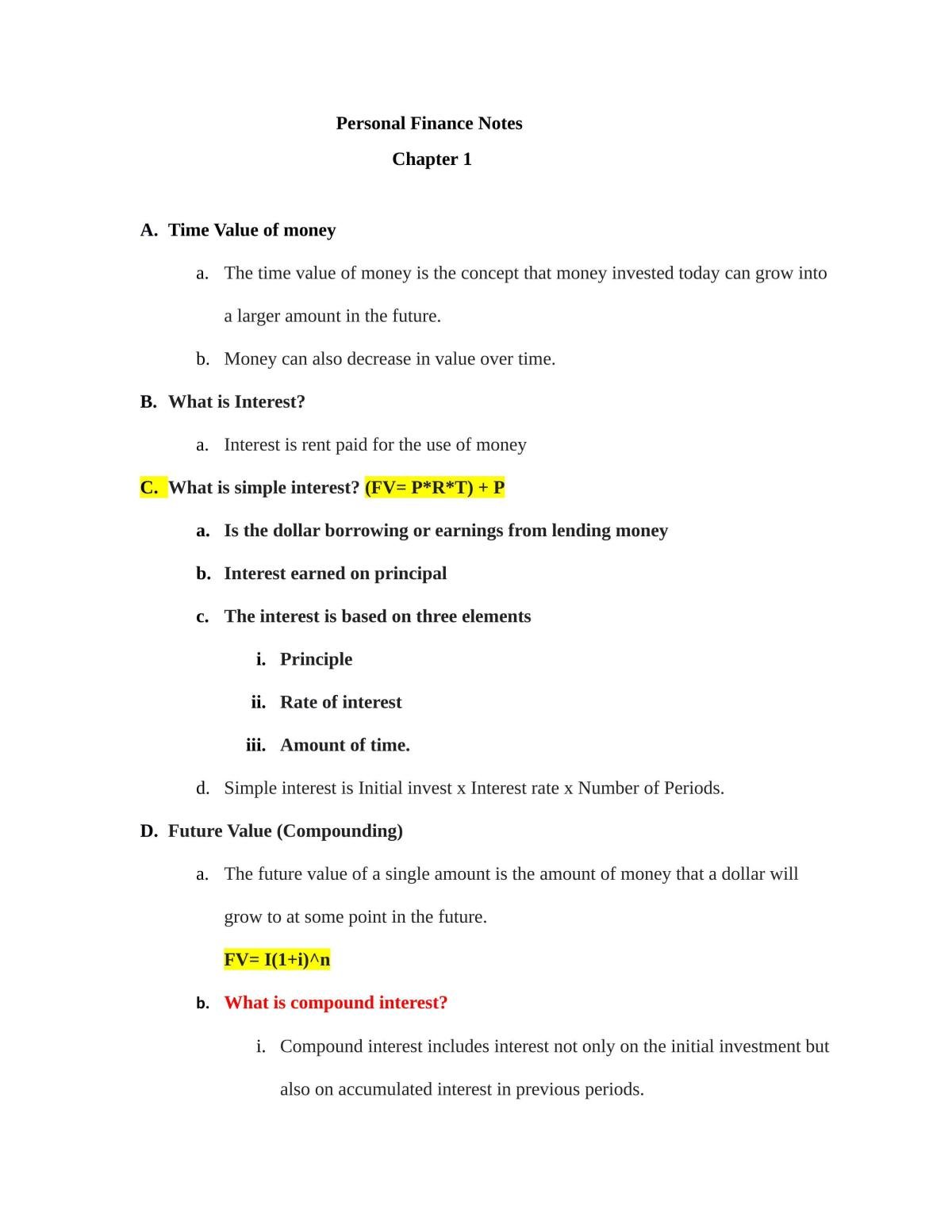

This image represents some foundational concepts in managing personal finance for BBA students. The details within these notes guide learners through the complexities of budgeting, saving, and financial planning.

At the core of managing personal finance is the understanding of budgeting. To budget effectively, students need to track their income sources, categorize their expenses, and set financial goals. Creating a careful budget allows students to allocate their resources astutely and avoid unnecessary debt. For example, a common budgeting method, the 50/30/20 rule, suggests that students allocate 50% of their income to needs, 30% to wants, and 20% to savings. This structure not only promotes saving but also teaches restraint and prioritization.

In tandem with budgeting, managing personal finance bba notes should emphasize the importance of an emergency fund. Ideally, financial experts recommend having at least three to six months’ worth of living expenses saved. This fund acts as a safety net during unexpected situations like job loss or emergency medical expenses, and is an integral part of any sound financial strategy.

Debt can be a significant hurdle for many young adults, especially students who may already be struggling with student loans. Comprehensive managing personal finance bba notes should include effective strategies for dealing with debt. Understanding the difference between ‘good’ debt (like mortgages or student loans) and ‘bad’ debt (such as high-interest credit card balances) is crucial for managing financial health.

Students should consider following the snowball method for paying down debt, where they focus on paying off smaller debts first while making minimum payments on larger ones. This method not only accelerates the debt elimination process but also helps build motivation as students celebrate small victories. Overlaying this with a solid plan for avoiding future debt can further fortify financial stability.

An essential aspect of managing personal finance bba notes revolves around savings and investment. Successful financial management requires individuals to save regularly, regardless of how small the amount may be. Establishing a habit of savings engrains discipline and helps in accumulating wealth over time.

Beyond saving, students should be educated about investments—an area often intimidating due to its complexity. The realm of investing offers numerous avenues, including stocks, bonds, mutual funds, and real estate. Each option has its risk factors and potential returns, so it’s necessary for students to conduct thorough research and understand their risk tolerance before diving in. Investment accounts such as Roth IRAs can be especially advantageous for young investors looking to capitalize on tax-free growth.

Another crucial element often overlooked in managing personal finance is insurance. Students need to consider various types of insurance to protect their assets and income. Health insurance, renters insurance, and auto insurance can prevent significant financial setbacks due to unforeseen disasters or accidents.

Furthermore, life insurance should be a consideration for those with dependents or significant assets. It ensures that loved ones are taken care of in the event of unforeseen circumstances. Analyzing insurance needs and coverage options is vital to being financially responsible.

Setting short-term and long-term financial goals is a key component in effective financial planning. Managing personal finance bba notes should guide students in articulating their goals clearly. Short-term goals might include paying off a credit card in the next six months or saving for a vacation, while long-term goals could involve planning for retirement or saving for a down payment on a house.

Goals should be measurable and time-bound, allowing students to monitor their progress. Tracking progress can be an effective means of staying motivated and making adjustments to spending habits as necessary. Establishing regular reviews of financial goals can inspire continual assessment and adjustment as life circumstances change.

The journey of managing personal finance can be supported by various financial literacy resources. Workshops, podcasts, seminars, and books on personal finance can provide valuable insights and strategies. Many universities offer financial counseling services that can be an excellent resource for students. Engaging with these materials can enhance one’s understanding and application of financial principles.

Additionally, networking with peers or financial professionals can offer mentorship opportunities and guidance in navigating personal finance challenges. The exchange of experiences and advice can enrich understanding and lead to better financial decision-making.

In summary, mastering the art of managing personal finance is a journey that involves understanding budgeting, debt management, savings, investment strategies, insurance, and goal setting. For BBA students, effective management of their finances is key not just to academic success but also to their future livelihoods. Emphasizing these concepts through comprehensive personal finance notes can empower them to create a financially stable life.

As the landscape of finance continues to evolve with technological advancements, students must stay informed about effective personal finance management tools. Financial apps, budgeting software, and investment platforms are increasingly popular and can provide significant assistance to students in tracking their finances and managing their budgets.

The ability to learn and adapt to new financial instruments will undoubtedly influence the future of managing personal finance for BBA students. Therefore, embracing a mindset of continual learning and adaptation can empower students to take charge of their financial futures.

Ultimately, by incorporating the principles outlined in this discussion of managing personal finance bba notes, students can position themselves for success not only in their academic pursuits but throughout their lives. Financial literacy is a lifelong journey, and starting this journey with a solid foundation in personal finance can yield substantial dividends in the long run.