Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Managing personal finance is a critical skill that allows individuals to achieve their financial goals while navigating the complexities of modern-day expenses, savings, and investments. It is essential to develop a strong foundation in personal finance management to ensure a secure and prosperous future. The following discussion will explore various aspects of managing personal finance, emphasizing the importance of budgeting, saving, and investing, with references to a useful resource for further reading.

A comprehensive managing personal finance PDF can serve as a valuable guide for individuals seeking to enhance their financial literacy. Such resources often cover fundamental concepts, practical strategies, and expert insights that can empower readers to take charge of their financial journey. In this age of information, having downloadable materials like PDFs can make a significant difference in how we learn and implement personal finance management.

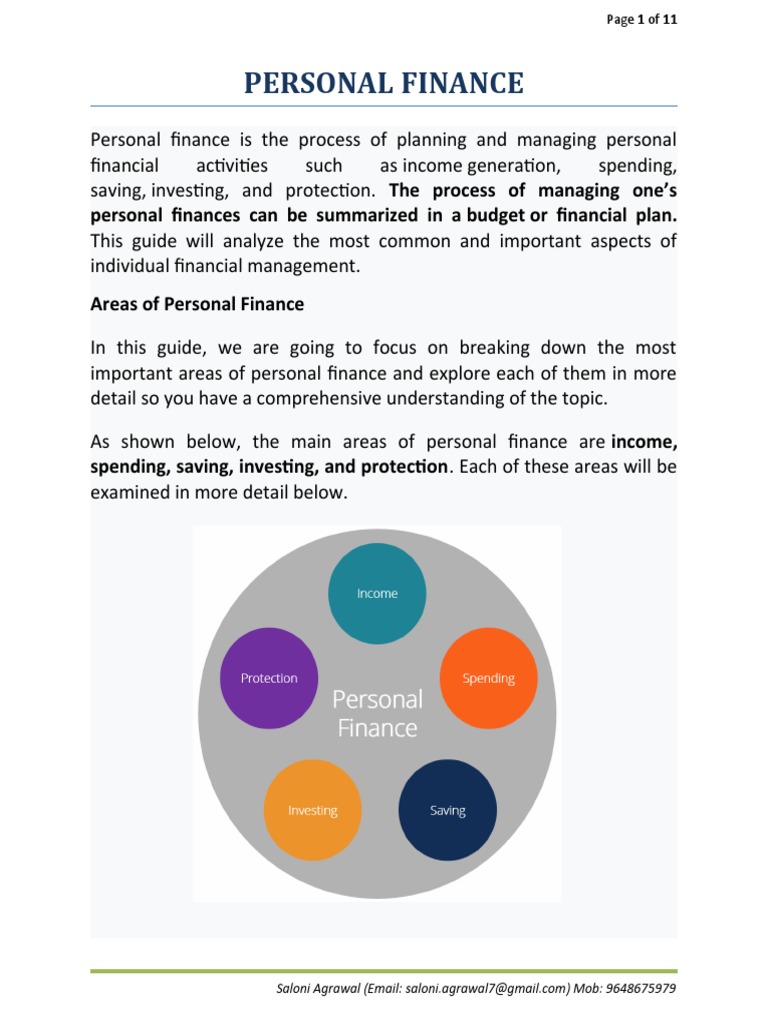

At the heart of managing personal finance lies the necessity of understanding key concepts such as income, expenses, savings, and investments. These components often interact with each other, and learning to balance them effectively is crucial for financial success. Below are various areas to consider when delving into personal finance.

Budgeting is perhaps the most crucial step in the journey of managing personal finance. It entails creating a spending plan that mirrors your income and expenditures. The objective of budgeting is to ensure that you spend wisely and allocate funds towards savings and investments. Without a solid budget, individuals may find their financial situations challenging as unexpected expenses can derail financial stability.

Saving is an integral part of managing personal finance. Establishing an emergency fund is a recommended strategy that many financial advisors advocate. An emergency fund typically contains three to six months’ worth of living expenses to safeguard against unforeseen circumstances such as job loss or sudden medical expenses.

Another vital aspect of savings is understanding your savings goals. Whether you are saving for a home, a car, or retirement, having clear objectives can provide motivation and direction. Utilizing tools like high-yield savings accounts or automated savings plans can help individuals progress towards their goals with minimal effort.

Investing can dramatically enhance one’s financial situation over time. Unlike saving, which primarily focuses on preserving cash, investing involves purchasing assets that can potentially grow in value. A managing personal finance PDF can offer guidance on various investment avenues, from stocks and bonds to real estate and mutual funds.

One of the significant areas of investment that a managing personal finance PDF might address is risk management. Understanding your risk tolerance before embarking on any investment journey is essential. Different investments carry varying levels of risk, and being cognizant of your comfort level with potential losses can help shape your investment strategy.

Retirement planning is another critical aspect of managing personal finance. Early investments can yield substantial returns, thanks to the power of compounding interest. Many people overlook the importance of retirement accounts, such as 401(k)s or IRAs, which offer tax advantages and growth potential. A solid understanding of these vehicles can lead to a more secure financial future.

This visual guide represents the essence of managing personal finance through a detailed PDF resource. Engaging with such materials can provide clarity and actionable insights, enhancing your financial management skills.

Credit management is a fundamental aspect of managing personal finance that warrants special attention. Understanding how credit scores work and the implications they have on financial decisions can be crucial. Factors like timely payments, credit utilization, and length of credit history play a significant role in determining your creditworthiness.

Debt can be one of the most significant hurdles in managing personal finance. Whether it’s student loans, credit card debt, or mortgages, devising a strategy to manage these debts is vital. Strategies such as the snowball method or avalanche method can help individuals systematically pay down debts while maintaining motivation.

With the internet at our fingertips, numerous resources are available for individuals looking to enhance their financial knowledge. Financial blogs, online courses, and downloadable PDFs can serve as excellent tools in the journey toward effective managing personal finance. Engaging with diverse resources can help you discover various perspectives and strategies suited to your financial situation.

Furthermore, considering professional advice from certified financial planners can furnish personalized insights tailored to your unique financial landscape. Their expertise can assist you in setting financial goals, creating budgets, and establishing a roadmap to financial independence.

The field of personal finance is constantly evolving, influenced by economic changes, technological advancements, and shifting societal values. Therefore, continuous education is essential. Engaging with updated managing personal finance PDF materials can help individuals stay informed about the latest trends and strategies to improve their financial circumstances.

Many platforms offer subscriptions to newsletters or e-books that provide ongoing financial education. These materials can deliver timely information and actionable steps to incorporate into your financial practices. By making a commitment to lifelong learning, you position yourself for greater financial success.

In conclusion, managing personal finance is an essential journey that requires understanding various concepts, strategies, and resources available. Utilizing tools such as PDFs can enhance your learning experience, allowing for deeper comprehension and practical application of financial principles. By focusing on budgeting, saving, investing, credit management, and education, individuals can take tangible steps towards achieving their financial goals and securing a prosperous future.

As you propel forward in your financial journey, remember that the path may be complex, but with the right strategies and resources, effective personal finance management is within reach. Embrace the knowledge and tools at your disposal, and take confident steps toward a financially secure life.