Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Have you ever felt overwhelmed by managing your personal finances? Many of us struggle with keeping everything organized, from tracking expenses to planning for future savings. Fortunately, there’s a powerful tool that can help simplify this process: Microsoft Excel. Knowing how to leverage its features can turn a daunting task into a manageable one. Let’s dive into how Microsoft Excel can be your personal finance ally, making budgeting, tracking expenses, and planning for the future a breeze.

In a world filled with apps and online budgeting tools, you may wonder why you should stick to good old Microsoft Excel when managing your personal finances. The truth is that Excel provides an unparalleled flexibility that is hard to match. Unlike many specialized apps that limit your options, Microsoft Excel allows you to create customized spreadsheets tailored to your specific needs.

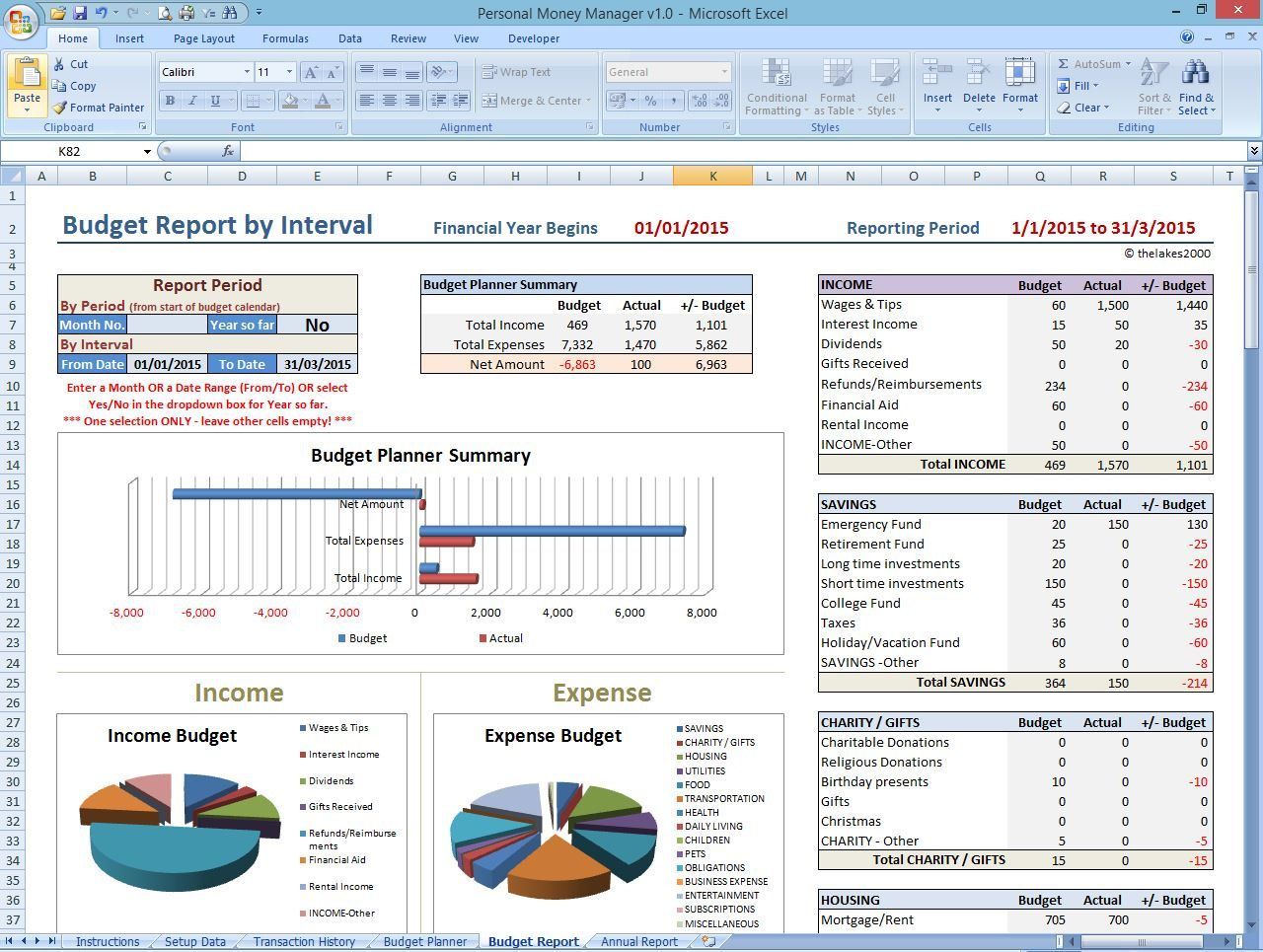

Excel’s grid layout lets you visualize your data neatly, making it easier to analyze your spending habits and savings over time. In addition, with its numerous functions and formulas, you can automate calculations, saving you both time and hassle. Plus, as a widely used program, Excel skills are incredibly valuable in various contexts beyond just personal finance.

The first step to taking control of your finances is creating a budget. A budget helps you understand where your money is going and can guide your spending and saving decisions. Using Microsoft Excel for this task is a smart choice, as it allows for easy updates and adjustments as your financial situation changes.

To start, open a new workbook and label the first few columns for your income sources and monthly expenses. Common categories include housing, utilities, groceries, transportation, and entertainment. As you fill in each category with its respective dollar amount, Excel can automatically calculate your total income and expenses, allowing you to see the balance at a glance.

Once your budget is established, the next step is regular tracking and analysis of your spending. This is where Microsoft Excel begins to shine. Create a new worksheet dedicated to tracking your daily or weekly expenses. You can categorize your expenses further, using subcategories within the major headings you’ve set up in your main budget.

Each time you make a purchase, simply log it into your tracking worksheet. Using Excel’s powerful sorting and filtering features, you can easily see patterns in your spending. Do you tend to overspend on dining out? Are there areas where you consistently save? Analyzing these patterns is crucial for adjusting your budget and improving your financial health.

Setting savings goals is a vital part of any financial plan. With Microsoft Excel, you can create a dynamic savings tracker that will provide motivation and clarity towards achieving your goals. Whether you are saving for a vacation, a new car, or a rainy day fund, visualizing your progress will help keep you accountable.

To create a savings tracker, allocate a portion of your monthly budget towards your savings goal. Input your target amount and the expected completion date. As you contribute towards your goal, update the saved amount in Excel to see how long it will take to achieve your target based on your current saving rate. You can even create graphs to visualize your progress. This interactive approach makes saving less of a chore and more of an achievement.

Once you’ve mastered the basics, you might be intrigued by some of Excel’s more advanced features that can take your personal finance management to the next level. Utilizing formulas such as SUMIF, AVERAGEIF, and IF statements can help automate your budgeting process even further.

For instance, the SUMIF function can add up expenses that fall under a particular category. This means you can easily see how much you spend on groceries each month without manual addition. Furthermore, setting up charts and graphs will help visualize this data, making it not only informative but also visually engaging.

Collaboration in managing finances can sometimes be a necessity, especially when budgeting for a joint household. Microsoft Excel makes it easy to share your workbook with other individuals, allowing for transparency in finances between partners or family members.

When sharing, ensure that you maintain the integrity of your formulas and formulas are locked or protected from accidental editing. This way, each user can update expenses or add details while keeping the structure intact. Having interconnected finance tracking can lead to a cooperative effort in reaching your financial goals together.

Mastering personal finance management is a journey, but Microsoft Excel provides invaluable assistance along the way. From budgeting to tracking expenses and setting savings goals, the versatility and power of Excel can lead you to a clearer understanding of your finances and ultimately, to financial peace of mind. Whether you are a novice or a seasoned expert in personal finance, taking the time to learn and utilize Microsoft Excel will enhance your experience and aid in your financial decisions.

Embrace the journey of financial mastery with the right tools at your disposal. Remember, every great achievement starts with a simple step towards your goals. Let Microsoft Excel be that step for you. Take your time, learn the functions, modify the templates, and watch your financial clarity grow.

It is essential to adapt your learning process. Don’t be afraid to experiment with Excel; numerous resources are available online to help expand your knowledge. Many tutorials cover everything from the basics of entering data to complex pivot tables for deep data analysis. You will find that using Microsoft Excel for personal finance not only simplifies your tasks but also empowers you with the control you rightfully deserve over your finances.