Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In the evolving landscape of financial education, the significance of structured learning about finance cannot be overstated. One aspect that is particularly critical for individuals seeking financial stability is understanding the core components of personal finance management. This article will delve into a comprehensive personal finance management course outline, highlighting essential topics and resources to enhance your financial literacy.

When engaging in personal finance management, having a solid course outline serves as a roadmap to guide learners through the intricate world of finances. A well-structured outline not only ensures that essential topics are covered but also facilitates a deeper understanding of the principles that govern financial decisions. For individuals ready to take charge of their financial future, exploring a personal finance management course outline is an invaluable first step.

The personal finance management course outline typically consists of several key components that are crucial for developing a comprehensive understanding of finance. These components encompass budgeting, saving, investing, and debt management, among others. Each of these topics plays a vital role in shaping financial habits and influencing future financial decisions.

Budgeting is often deemed the cornerstone of personal finance management. A personal finance management course outline should begin with this invaluable skill. Learning how to create and maintain a budget establishes control over your finances and provides clarity on spending habits. Participants will explore various budgeting techniques, such as the 50/30/20 rule, zero-based budgeting, and envelope budgeting methods.

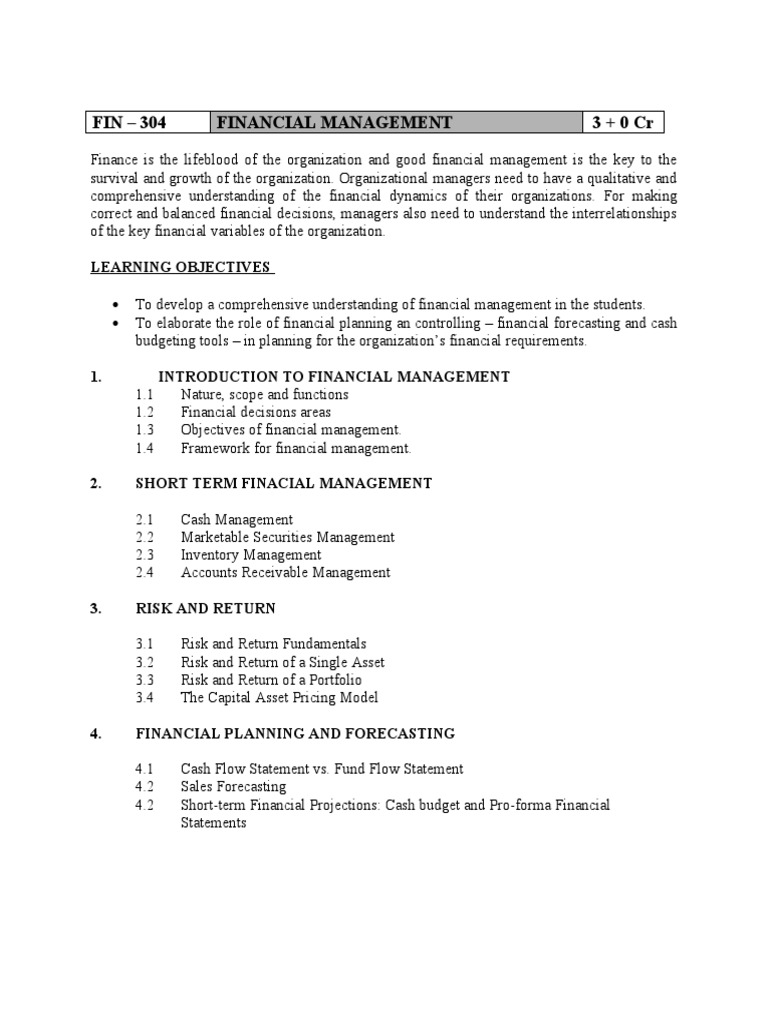

This image illustrates the framework of a financial management course outline, showcasing its importance in personal finance education. For additional insights on budgeting strategies, you may want to visit NerdWallet’s budgeting basics.

Following budgeting, the next crucial topic within the personal finance management course outline is saving. Participants should be exposed to the various saving techniques that promote financial security. This includes setting up emergency funds, allocating funds for retirement, and understanding the role of high-yield savings accounts. By establishing a savings routine, individuals can better prepare for unexpected expenses and future goals.

Investing is another essential aspect covered in a personal finance management course outline that cannot be overlooked. Understanding the basics of investing, including stocks, bonds, and mutual funds, will empower participants to make informed decisions about growing their wealth. Furthermore, it is important to introduce risk management concepts and portfolio diversification to ensure a balanced investment approach.

Debt management is sometimes perceived as a daunting topic; however, it is integral to a personal finance management course outline. Participants will learn the difference between good and bad debt, as well as strategies for managing debt effectively. This includes knowledge about credit scores, interest rates, and repayment plans. By becoming informed about debt management, individuals can take proactive measures to minimize financial stress and improve their credit standing.

The personal finance management course should also dedicate time to explore various financial instruments. Understanding the different options available, such as credit cards, loans, and investment accounts, helps learners make informed decisions. Detailed analyses of the pros and cons of each instrument can aid in developing effective personal finance strategies.

Estate planning is often overlooked in many personal finance management course outlines but is an essential element of comprehensive financial education. Participants should learn about wills, trusts, life insurance, and the impact of taxes on an estate. By incorporating estate planning into the course outline, individuals can better prepare for the financial future of their beneficiaries.

In today’s digital age, leveraging financial tools and resources significantly enhances personal finance management. A well-structured course outline will introduce participants to budgeting apps, investment platforms, and credit monitoring services. Teaching individuals how to use these tools can lead to more effective financial management strategies and improved financial literacy.

Equipping students with real-life applications is a critical aspect of any personal finance management course outline. By using case studies and simulations, participants can see how financial theories translate into practical applications. Engaging in role-playing scenarios or developing financial plans for hypothetical situations can enhance the learning experience.

To ensure the personal finance management course outline is engaging, incorporating interactive learning opportunities is crucial. Group discussions, workshops, and guest speakers can provide diverse perspectives and insights into personal finance management. These interactive components not only make the course more enjoyable but also create a collaborative learning environment.

In conclusion, establishing a well-defined personal finance management course outline is essential for anyone seeking to enhance their financial literacy and skills. Covering vital topics such as budgeting, saving, investing, debt management, and estate planning creates a comprehensive educational framework. By emphasizing real-life applications and utilizing modern financial tools, participants can navigate their financial journeys with confidence and competence. As financial education evolves in importance, committing to lifelong learning in personal finance will undoubtedly pave the way to achieving financial security and independence.