Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

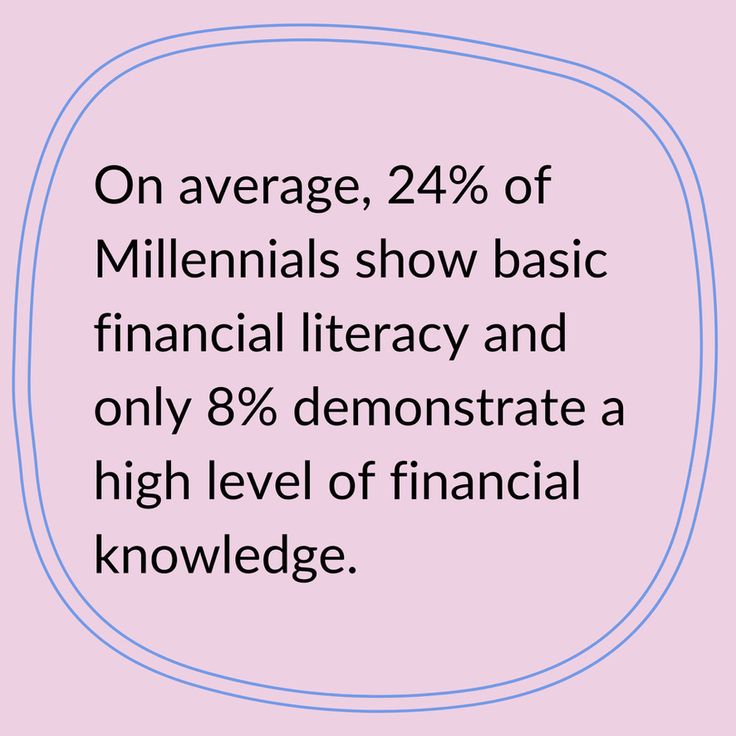

Welcome to your ultimate guide on personal finance tips for millennials. Navigating the world of finance can feel overwhelming, especially when balancing student loans, starting a career, and planning for the future. This article is designed to help you break down essential finance tips, gear you up for investing, and make informed decisions that will benefit you in the long haul. Whether you’re just getting started or looking to sharpen your financial strategies, let’s dive into some effective techniques.

Creating a budget is one of the most crucial personal finance tips for millennials. A budget acts as a roadmap for your spending, helping you track where your money goes and allowing you to allocate funds for savings and investments. Here are steps to create a practical budget:

By keeping a clear view of your financial commitments, you can make informed decisions that contribute to personal growth and financial stability.

One of the most impactful personal finance tips for millennials is to start investing early. Compound interest plays a massive role in growing your wealth over time. Here are key points to consider when beginning your investment journey:

As a millennial, it’s crucial to cultivate healthy investment habits early. Here are some effective strategies that can aid you in building a robust financial future:

One of the most effective personal finance tips for millennials is to diversify your investment portfolio to spread risk. Here’s how you can do it:

Stay informed about financial markets and investment trends. Follow credible resources such as financial news sites, investment podcasts, and informative blogs that discuss personal finance and investing. This knowledge will empower you to make sound decisions and spot potential investment opportunities.

Establish concrete, measurable goals. Whether it’s saving for a house, retirement, or travel, having a clear purpose guides you on how to allocate your resources. Break your goals into short-term and long-term objectives to maintain focus and motivation.

An often overlooked personal finance tip for millennials is establishing an emergency fund. Here’s why and how to do it:

Debt can hinder your financial goals. Start with these actionable personal finance tips for millennials to reduce and eliminate debt:

Focus on your high-interest debts first (like credit card debt) using the avalanche or snowball method:

Stay organized by using apps and spreadsheets to monitor your debt repayment status and financial goals, leading to better management.

Networking extends beyond job-hunting; it can provide valuable support in your financial success. Consider these tips:

Visualizing your financial journey and setting personal finance tips for millennials into action is indispensable as you create a robust financial foundation. Use each step discussed here to move towards a secure and manageable financial future.

In conclusion, being proactive and informed about your finances is essential for millennials. Implement these personal finance tips to cultivate a healthy relationship with your money, where you feel secure, invested, and in control of your future. Remember, every little bit of effort adds up over time. Whether you’re tracking expenses, investing wisely, or planning for emergencies, every decision strategically propels you closer to your financial goals. Start today, and watch how these practices transform your financial well-being over time.

Embrace the journey to financial literacy, and empower yourself with valuable knowledge that paves the way for financial success.