Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Managing small business finance is crucial for the success and sustainability of any small enterprise. As an entrepreneur, understanding financial management can lead you not only to profitability but also to stability during challenging economic times. In this article, we’ll delve into various strategies, tools, and small business finance articles that can aid you in maintaining a healthy financial structure for your business.

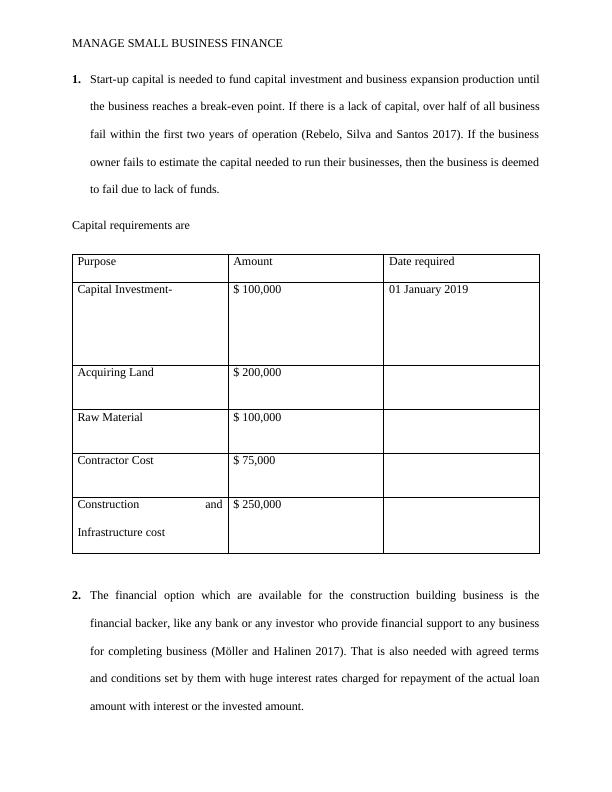

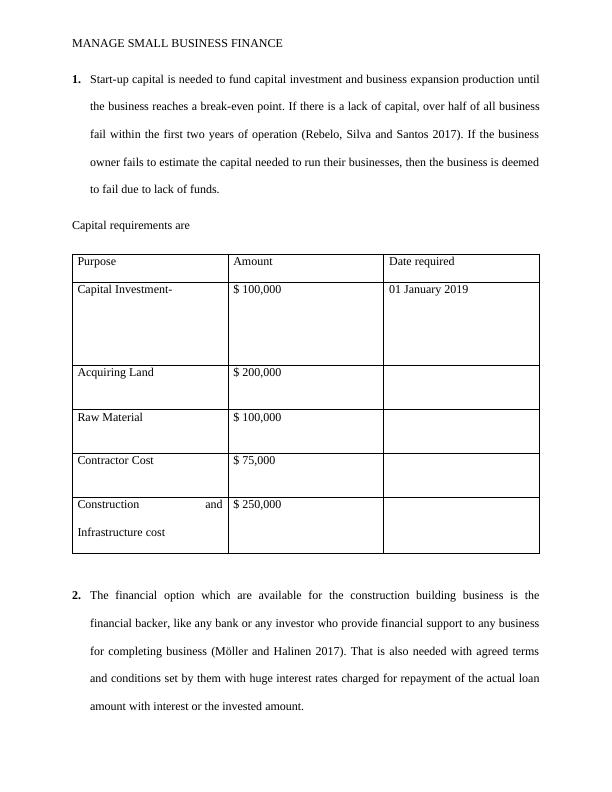

Financial management encompasses a variety of practices including budgeting, forecasting, cash flow management, and investment planning. If you’re a small business owner, having a comprehensive understanding of these components is vital. Regularly reviewing financial statements, assessing your cash flow, and understanding your cost structures can help you make informed decisions.

Budgeting allows you to create a detailed analysis of your revenues and expenses over a specified period. A well-planned budget can serve as a roadmap, guiding you through your financial decisions for the year. You can track whether your actual expenses align with your projections. These discrepancies can indicate areas where you need to adjust your spending or increase your revenue efforts.

Graphical representations of financial data can make it easier to spot trends and make decisions quickly. Whether through pie charts, line graphs, or bar charts, visual tools can be invaluable in understanding your business’s financial position. Many of the best small business finance articles emphasize the importance of not just looking at numbers but interpreting them strategically.

Cash flow is the lifeblood of any business. It is essential to ensure that your business maintains a positive cash flow to fulfill operational needs. This can be achieved through a few key strategies:

For further insights on cash flow management, consider exploring small business finance articles that focus on seasonal trends and cyclical patterns in your industry.

In today’s digital age, various financial management tools can simplify budgeting and forecasting processes. These tools assist in automating invoicing and tracking expenses, ensuring you have real-time access to your financial data. Some well-regarded platforms include:

Consulting small business finance articles can provide reviews and tips on leveraging these tools effectively to meet your financial management needs.

While cost-cutting measures can be enticing during tough financial periods, investing in your business often leads to greater long-term benefits. This can include training for employees, marketing initiatives, or upgrading technology. Each of these investments can contribute significantly to your bottom line.

Many small businesses leverage debt as a strategy to finance expansion or improve cash flow. However, managing debt is crucial for maintaining financial health. It’s essential to evaluate the terms of any loans and ensure that repayments fit within your cash flow constraints. Understanding when and how to use debt as a financial tool can be as important as knowing how to save.

Financial uncertainty is a reality for any business. Setting aside resources for unexpected situations can prevent minor setbacks from turning into major issues. An emergency fund provides a buffer that allows your business to remain operational even during tough financial times.

Continuous improvement is a hallmark of successful businesses. Engaging with small business finance articles regularly can keep you updated on the latest trends, strategies, and tips in financial management. Many articles detail case studies, providing insights into how similar businesses overcame financial challenges or capitalized on growth opportunities.

Moreover, subscribing to newsletters or joining forums can enhance your learning and provide a platform for discussion with other business owners. Engaging with a community of peers can provide accountability and encourage the sharing of knowledge.

If navigating finances seems overwhelming, hiring a financial advisor could be a beneficial option. Professionals can offer personalized advice tailored to your unique business needs and help you implement financial strategies effectively. Collaborating with experts can also extend your financial literacy, empowering you to make more informed decisions moving forward.

Successfully managing small business finance is a multi-faceted endeavor that requires discipline, insight, and proactive measures. By understanding budgeting, cash flow, and the importance of leveraging financial technologies, business owners can lead their ventures to sustainable growth. Additionally, continuously educating yourself through small business finance articles, investing wisely, and opening discussions about financial management can align your business’s financial goals with your overall vision for growth.

Embrace financial management as a vital aspect of your entrepreneurial journey. Just as with any other area of business, diligence and informed strategies can significantly impact your success. By following the practices suggested in this article, you will be well on your way to achieving a stable financial foundation for your business.