Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In the fast-paced world of finance, understanding the intricacies of stock market investing by Jason Kelly is essential for anyone looking to build wealth and secure their financial future. Whether you’re an experienced investor or just starting out, the wisdom imparted by bestselling financial author Jason Kelly can guide you through the complexities of market trends and investment strategies. This article delves into fundamental principles of investing while showcasing insights that can help you excel in stock market endeavors.

One of the key lessons from Jason Kelly’s writing is the importance of a strong foundation in stock market investing. Many novice investors jump in without properly understanding market dynamics, often leading to costly mistakes. Kelly emphasizes the need for research and education before making investment decisions.

Stock market investing by Jason Kelly relies heavily on recognizing and interpreting market trends. This includes not just watching stock prices but understanding economic indicators, company performances, and global events that can all influence market behavior. For example, being aware of quarterly earnings reports or changes in leadership can provide insights into how a company’s stock may perform. By grasping these trends, investors can make more informed choices.

Another principle that resonates with Jason Kelly’s investment philosophy is diversification. It’s a strategy aimed at reducing risk by spreading investments across various sectors and asset classes. Many investors might think that putting all their money into a single stock is a good idea—especially one they’re excited about—but Kelly warns against this. A well-diversified portfolio can withstand the ups and downs of the market much more effectively.

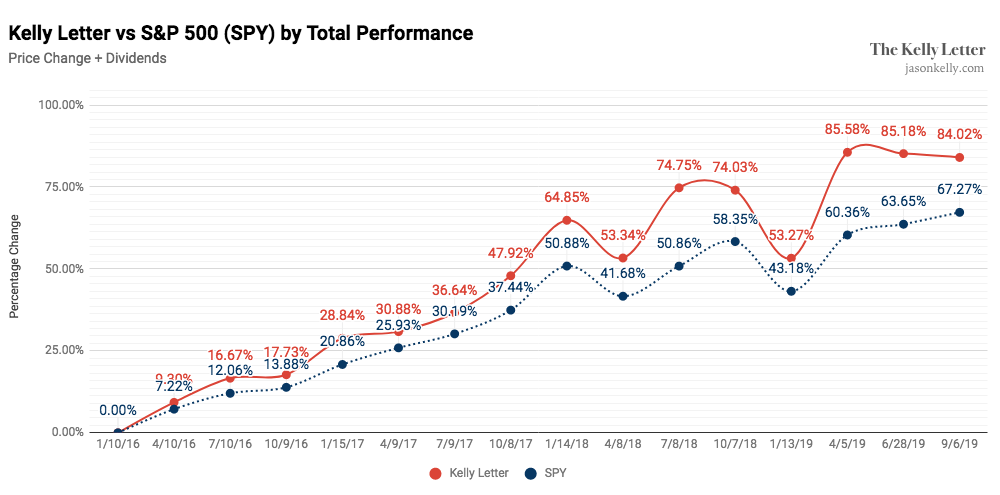

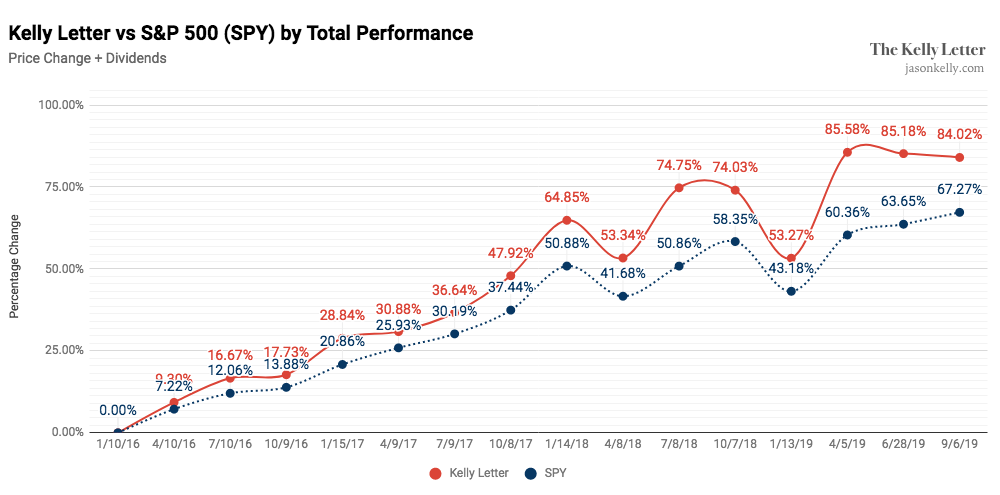

To illustrate the power of a well-informed investment strategy, consider the following chart that represents historical stock performance over time. By understanding these visual cues, investors can better grasp the volatility of the stock market and position themselves strategically.

This chart captures a significant snapshot of market performance, allowing us to visualize how well certain investments can fare over time. Observers should pay close attention to the consistent growth and the occasional dips that naturally occur. Jason Kelly believes that understanding these patterns can empower investors to take proactive measures rather than reactive ones.

When engaging in stock market investing by Jason Kelly’s standards, emotional discipline is paramount. Many articles discuss the psychological aspects of investing, emphasizing how emotions can skew our perceptions and decision-making. Fear can lead to premature selling during downturns, while greed may result in chasing after stocks without proper evaluation. Kelly advocates for a balanced approach that couples emotional intelligence with analytical thinking.

Another essential lesson from Jason Kelly’s investment teachings is the distinction between long-term strategies and short-term gains. While some investors may seek to flip stocks for immediate profits, Kelly suggests that one should aim for long-term stability. This involves investing in sound companies with strong fundamentals rather than chasing trends. Such an approach not only lowers risk but also positions investors to capitalize on compounding returns over time.

Jason Kelly offers a plethora of resources that new and seasoned investors alike can leverage to bolster their stock market investing strategies. Below are some tools and resources inspired by his techniques that investors can take advantage of:

A critical takeaway from Kelly’s approach is the necessity of setting realistic financial goals. Short- and long-term goals can be vastly different in nature, and understanding these variances is key to stock market investing by Jason Kelly. For instance, a short-term goal might focus on a specific return on an investment, while a long-term objective could aim to build a retirement portfolio over decades. Recognizing and differentiating these goals can help in crafting an effective investment strategy.

In addition to setting goals, staying informed is crucial in stock market investing by Jason Kelly. The market is continuously evolving, and investors need to adapt with changing economic conditions, emerging technologies, and new investment vehicles. Subscribing to finance newsletters, listening to podcasts, and following financial news outlets are excellent ways to maintain awareness of the market landscape.

Patience is often overlooked but is equally important in investment trajectories. As advocated by Jason Kelly, a well-paced approach allows investments to mature and reveals the true potential of market strategies. Too often, investors get impatient and alter their strategies based on short-term fluctuations. Long-term investments require time to develop, and understanding this can markedly enhance overall success rates.

Technology has drastically transformed stock market investing by Jason Kelly. From trading platforms to automated investing, technology equips investors with tools that were once unimaginable. Kelly encourages investors to stay abreast of technological advancements and consider how they can be integrated into personal investment strategies. By utilizing tech-savvy solutions, such as algorithmic trading or robo-advisors, investors can enhance their decision-making and increase efficiency.

Implementing risk management is another vital aspect of stock market investing by Jason Kelly. Every financial decision carries inherent risks, and understanding them is crucial for long-term success. Kelly offers practical steps for managing risk, including setting stop-loss orders, diversifying investments, and maintaining enough liquidity to weather market storms. A good investor acknowledges these risks and takes proactive measures to mitigate them.

In summary, stock market investing by Jason Kelly encapsulates a mixture of practical wisdom, strategic planning, and emotional discipline. Whether you are embarking on your investing journey or looking to refine your existing strategies, the principles laid out by Kelly can serve as a robust foundation. By embracing continuous learning, cultivating patience, and leveraging available resources, investors can successfully navigate the complex terrain of the stock market.

Ultimately, the goal of stock market investing is not just to accumulate wealth but to establish a financially secure future. With Jason Kelly’s sound advice and principles, you can make informed decisions that will pay dividends for years to come. Embrace the journey and remain committed to learning and growing as an investor.