Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

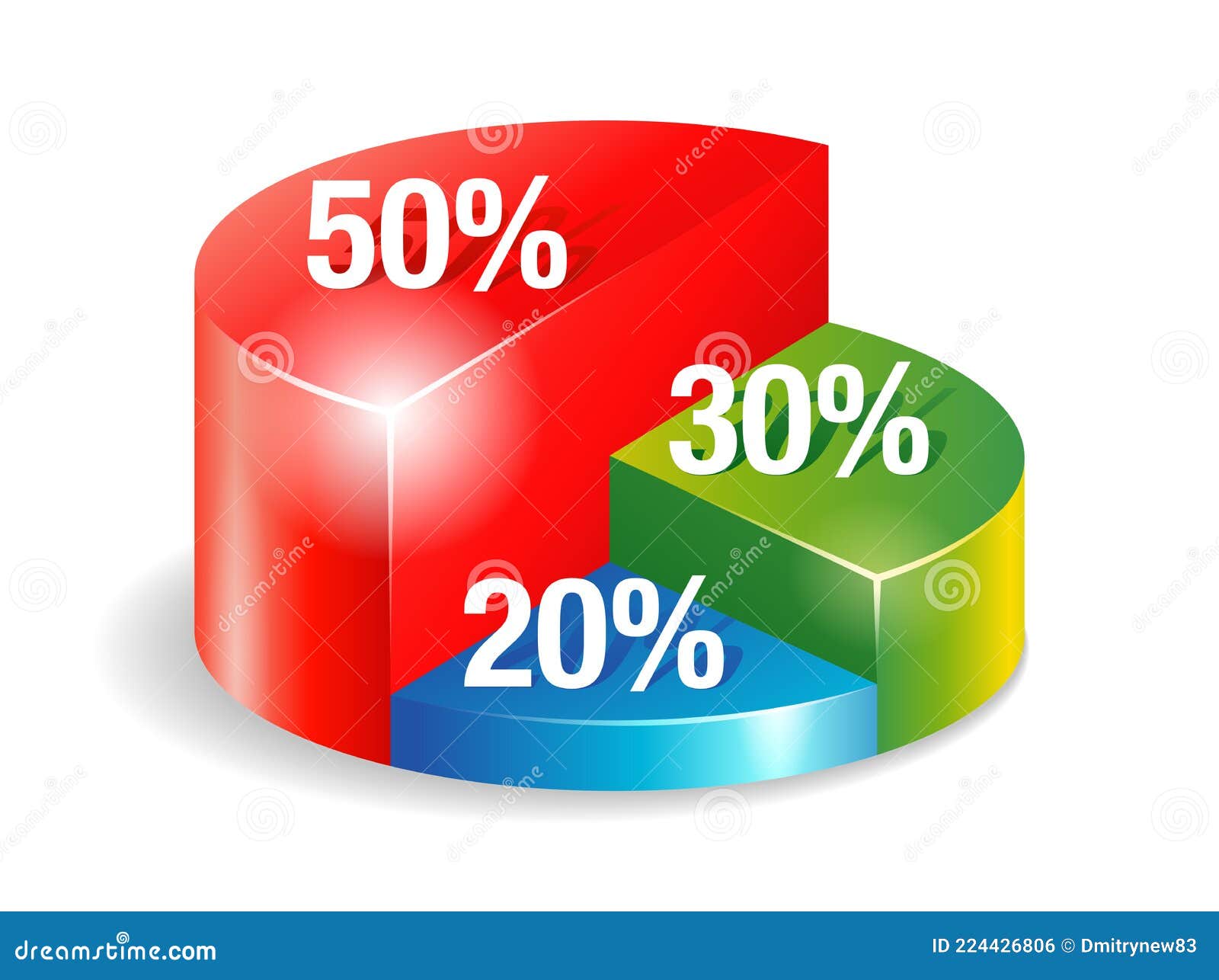

Managing personal finances can often feel overwhelming, but adopting a clear and simple budgeting method can make all the difference. One of the most effective strategies is known as The 50/30/20 Budget Rule: A Simple Budgeting Method. This approach divides your income into three essential categories: needs, wants, and savings, providing a balanced system to help attain financial stability.

The 50/30/20 Budget Rule: A Simple Budgeting Method is an accessible framework for managing your money effectively. Developed by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book “All Your Worth,” this budgeting rule emphasizes the importance of allocating your after-tax income into three categories:

In visual format, the 50/30/20 Budget Rule can be easier to comprehend. This diagram illustrates how you might allocate your income effectively towards needs, wants, and savings. By examining your financial flow visually, you can make more informed decisions about where to cut back and where to invest.

To implement the 50/30/20 Budget Rule effectively, it’s crucial to track your expenses and revenue accurately. Start by calculating your total monthly income after taxes. This is the foundation upon which you will base your budget. Next, categorize your expenses into the four listed areas. Utilize apps or spreadsheets to record your spending, which helps in identifying trends and areas for improvement.

When breaking down your needs, reflect on what you truly cannot live without. Your housing costs, including rent or mortgage payments, should be prioritized, followed by utilities and groceries. Aim to keep this segment of your budget within 50% of your income. This portion must cover necessary expenses, thus limiting your room for error.

The 30% allocated for wants is where budgeting becomes more flexible. You may find that this category can fluctuate depending on your interests and lifestyle choices. However, being intentional about what constitutes a want versus a need is key. For example, dining out or ordering takeout is a want, while preparing meals at home would fall under needs.

In understanding how The 50/30/20 Budget Rule: A Simple Budgeting Method works, it’s critical to note that not all expenses are equal. Some may classify as both needs and wants depending directly on your lifestyle. The beauty of this budget is its adaptability. Allocate funds based on your unique situation, ensuring your financial strategy remains effective while aligning with your personal preferences.

The final 20% of the 50/30/20 Budget Rule is designated for savings. This includes building an emergency fund for unexpected expenses, contributing to retirement accounts, and paying down debts. Establishing a savings habit early on can secure your financial future and pave the way to achieving your long-term goals. Consider setting up automatic transfers to your savings account to ensure consistency in your saving efforts.

Moreover, this segment can also mean making investments. Having a plan for investment can enhance your wealth over time, contributing positively to your financial health. With comprehensive attention given to savings and investments, you’ll be on a steady trajectory toward financial growth.

After establishing your budget following The 50/30/20 framework, it’s essential to monitor your progress regularly. Monthly reviews can reveal insights into your spending habits and overall financial behavior. Adjustments are often necessary, as life is full of unpredictable changes. It’s important to remain flexible and willing to adapt your budget to better fit your evolving needs.

Consider using budgeting software or mobile apps designed to help visualize and track your financial progress. These tools often provide additional features such as alerts and reminders, making it easier to stay within your budget. Technological support can empower you to adhere to The 50/30/20 Budget Rule: A Simple Budgeting Method effectively over the long run.

While this budgeting method offers a straightforward approach, many individuals stumble upon challenges. A common issue is impulse spending, particularly within the wants category. To mitigate this, set specific spending limits for each category—consider cash envelopes or a specific spending card just for wants.

Moreover, emergencies can derail plans quickly. Ensure your savings category is robust enough to handle unforeseen expenses. An adequate emergency fund can prevent you from dipping into your wants or needs, thus maintaining the integrity of your budget structure.

Ultimately, The 50/30/20 Budget Rule: A Simple Budgeting Method serves not just as a short-term solution but as a long-term strategy for sustainable financial health. By instilling good budgeting habits and fostering awareness of your spending patterns, you position yourself for ongoing financial success. Start today and embrace the path toward better money management.

As with any financial strategy, consistency is key. The objective is not perfection but progress. By regularly assessing your income and expenses against the 50/30/20 framework, you can continue to refine your approach, making adjustments as necessary to align with your personal goals.

In conclusion, mastering The 50/30/20 Budget Rule: A Simple Budgeting Method could be the pivotal step in achieving the financial stability you’ve long sought. Through disciplined tracking of your needs, wants, and savings, you can build a system that empowers you to manage your finances effectively. Start the journey towards financial well-being today, and take control of your economic future.