Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In today’s fast-paced world, managing personal finances has become essential for achieving both short and long-term financial goals. Whether you’re looking to save for a vacation, pay off debts, or simply keep your spending in check, budgeting apps offer a convenient solution. Here, we explore some of the best empowering budgeting apps available that can help you take control of your financial life.

Budgeting doesn’t have to be overwhelming, and these top seven budgeting apps make it easier than ever to track your spending. They provide tools that allow you to create personalized budgets, set financial goals, and even receive reminders about upcoming bills. With user-friendly interfaces, these apps cater to various financial situations and can help you develop healthy financial habits.

The increasing complexity of finances, alongside the convenience of technology, makes budgeting apps a vital tool for anyone looking to improve their financial literacy. These applications not only allow for straightforward tracking of expenses but also provide insights into spending patterns. This knowledge can empower you to make informed decisions.

With the help of financial fundamentals coaching, you can explore the six best budgeting apps that can transform your financial life. Each app offers unique features that cater to different users—from those who prefer manual tracking to those who want automated solutions. Let’s dive into what these apps have to offer:

One of the significant advantages of modern budgeting apps is their user-friendly interfaces. This ensures that even individuals who are not tech-savvy can navigate through the applications with ease. Simple designs, intuitive navigation, and helpful tutorials make it easier for users to create budgets and manage their financial data. Spend less time figuring out how the app works and more time focusing on your finances!

Tracking expenses can be a challenging task, especially if you have a busy lifestyle. Budgeting apps make this process seamless by allowing you to categorize your expenditures easily. From groceries to entertainment, every expense can be entered and tracked. This categorization will give you a clear picture of where your money is going and help identify areas where you can cut back.

Never miss a payment again! Most budgeting apps offer real-time notifications and reminders for upcoming bills or unusual spending. This feature not only helps maintain your financial health but also reduces the stress associated with financial management. You will receive alerts about due dates, helping you keep your credits intact and avoid late fees.

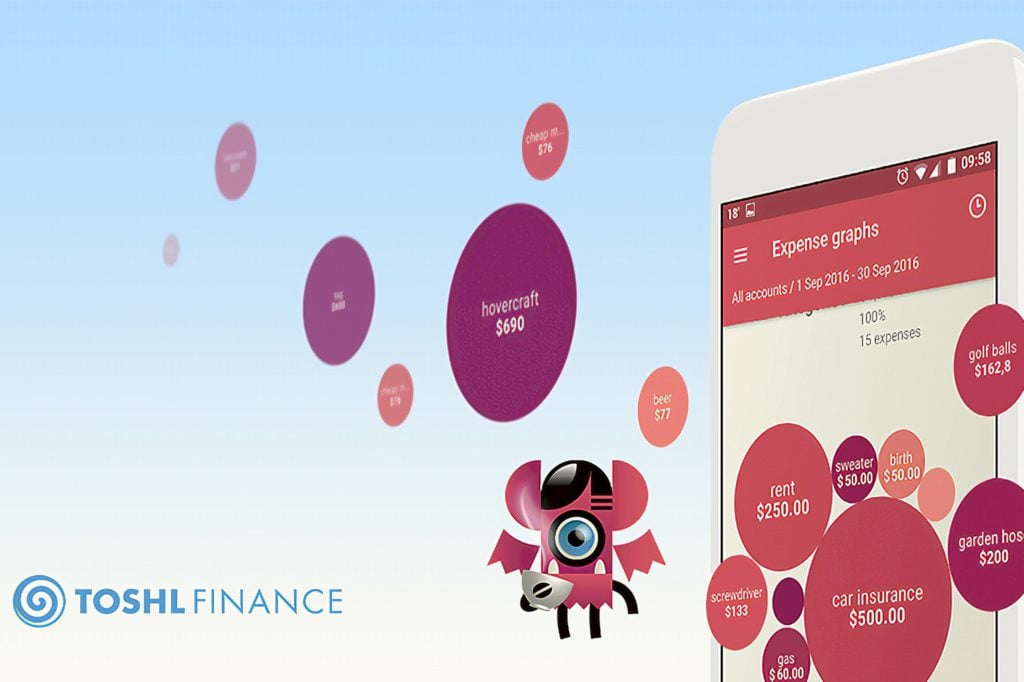

Setting financial goals is integral to budgeting. Whether you want to save for a new car, pay off credit card debt, or even prepare for retirement, budgeting apps allow you to set specific goals. Moreover, they often include visual tools like graphs and charts that help track your progress. Watching your goals get closer every month can be a motivating factor in maintaining your budgeting discipline.

Many budgeting apps allow you to link your bank accounts directly to the app. This feature enables automatic tracking of your transactions, which saves time and ensures accuracy. By syncing your bank accounts, you can easily view your entire financial landscape in one place, from checking and savings accounts to credit cards and loans.

Once you have been using a budgeting app for a while, you will have access to valuable insights into your spending patterns. Many apps generate reports that analyze your spending habits, showing you where you spend the most. This data is crucial for making informed adjustments to your budgeting strategies and improving your financial health over time.

For those seeking to take their financial management to the next level, some budgeting apps offer integration with financial advisors. This can be a great resource for additional guidance, helping users make informed decisions about investments, savings, and loans. The combination of technology and personal expertise can pave the way for comprehensive financial management.

Many budgeting apps come with educational resources, including articles, videos, and tutorials. This content can enhance your financial literacy, providing users with knowledge about budgeting principles, savings plans, and investment strategies. The more you learn, the better equipped you will be to manage your finances effectively.

No two financial situations are alike, which is why customization is key in budgeting apps. Most applications allow you to personalize your budget categories, set individual financial goals, and tailor notifications according to your preferences. With these features, you can create a budgeting experience that suits your lifestyle and needs.

Budgeting has become increasingly important in today’s economy, and with the help of innovative budgeting apps, anyone can take control of their financial journey. By exploring various options and features, you can find the perfect app that meets your personal finance needs. Whether you choose an app that enhances your understanding of financial fundamentals or one that streamlines your expense tracking, above all, the goal remains the same: empower yourself to make better financial decisions. Start budgeting today and watch your financial aspirations unfold!