Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In the realm of immigration and foreign investment, the EB-5 Visa program stands out as a transformative opportunity for affluent individuals seeking to secure a foothold in the United States. Yet, for many, the question remains: what is EB-5 investment? As we delve deeper into this multifaceted topic, we’ll explore not only the fundamentals of the program but also its implications for investors, regional centers, and the broader economy.

When examining the nuances of what is EB-5 investment, it’s essential to understand its inception. Established by Congress in 1990, the EB-5 Immigrant Investor Program allows foreign investors to obtain permanent residency in the U.S. by investing a stipulated amount in a new commercial enterprise that creates or preserves jobs for U.S. workers. The minimum investment requirement stands at $1 million, although in targeted employment areas, this amount can decrease to $500,000. Thus, potential investors must navigate a sea of regulations and opportunities to reap the rewards the program promises.

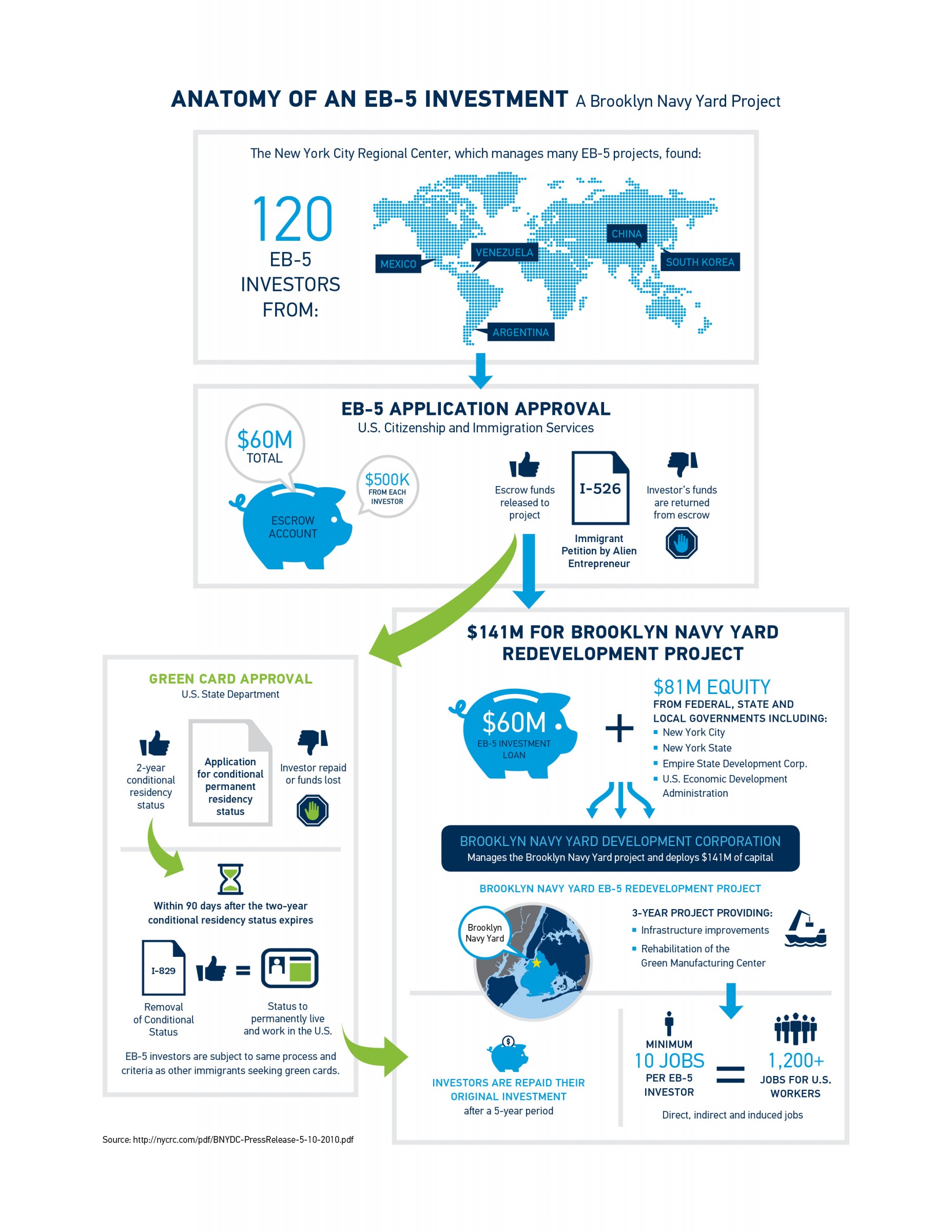

This infographic encapsulates the essence of what is EB-5 investment. By visualizing the flow of funds, job creation, and the benefits for both investors and local economies, it provides a comprehensive overview for those interested in exploring this pioneering investment strategy.

The EB-5 investment process is not merely about handing over a large sum of money; it’s a carefully structured program that hinges on specific requirements and expectations. First and foremost, potential investors need to connect with a designated regional center, which acts as a bridge between the investor and the commercial enterprise that will receive their funds.

When investing through a regional center, investors can pool their capital with others to fund larger projects, thereby more effectively meeting the job creation requirements of the program. Each regional center focuses on a specific geographic area or industry, enhancing the potential returns on investment while mitigating risk.

As with any investment, the EB-5 program carries its risks yet also promises significant rewards. Investors often find themselves navigating through complex legal frameworks, and missteps can lead to delays or denial of residency. Moreover, it’s vital for potential investors to conduct thorough due diligence on the regional center and the specific projects they are considering.

The rewards, however, can be substantial. Beyond obtaining permanent residency, successfully navigating the EB-5 process can lead to citizenship after fulfilling residency requirements, increased economic stability for the family, and the opportunity to live, work, and study in the U.S. Furthermore, many investors cite the ability to access world-class educational institutions for their children as a compelling reason to pursue EB-5 investments.

The EB-5 program does not just benefit individual investors and their families; it has a broader economic impact on communities. By fostering foreign investment, the program promotes growth in various sectors, from healthcare to real estate. The job creation goal—either a minimum of ten jobs per investor or direct job creation—stimulates local economies and contributes to infrastructure improvements.

The capital influx also aids in funding projects that might otherwise struggle to find investment, particularly in targeted employment areas where economic development is crucial. This delicate balance between investment and job creation ensures that the EB-5 program remains vital to America’s economy and immigration strategy.

The question of who should consider EB-5 investment is not easily answered. Generally, the program appeals to affluent individuals from countries with long waiting lists for green cards or from nations where political or economic instability makes the U.S. a strategic place for relocation. However, there’s also a growing faction of American citizens who are looking to secure residency for their overseas family members, thereby considering what is EB-5 investment for different reasons.

Additionally, high-net-worth individuals who are interested in diversifying their portfolios and investing in U.S. real estate or development ventures are increasingly drawn to the program. Understanding the financial implications and long-term benefits of residency status can help potential investors weigh their options wisely.

As we look ahead, the future of the EB-5 program remains somewhat ambiguous, particularly in light of changing political landscapes and regulatory scrutiny. Policy shifts could significantly alter the investment landscape, making it crucial for prospective investors to stay informed. Recent conversations in Congress regarding amendments to the program hint at the continuous evolution of what is EB-5 investment.

The prospects remain bright for individuals who engage in thorough research and select reliable regional centers. In navigating the challenges, they can unlock the potential of their investments while solidifying their place in a new home.

In conclusion, the EB-5 Visa program represents an alluring opportunity for foreign nationals to gain a foothold in one of the world’s most robust economies. Understanding what is EB-5 investment extends beyond the initial capital; it encompasses a broader narrative of opportunity, risk management, and economic development. For those willing to delve into the complexities of this program, the potential benefits can be transformative, not just for individuals but for entire communities across the U.S. As always, it’s critical to stay informed, perform due diligence, and seek professional advice when needed to navigate the intricate landscape of EB-5 investments.