Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

When it comes to personal finance, having a reliable savings account is essential for achieving your financial goals. One popular choice among consumers is the Chase Savings Account due to its convenience and features. If you’ve recently opened a Chase Savings Account or are considering doing so, you might be wondering what to do with your Chase Savings Account to maximize its potential. This comprehensive guide will walk you through the essentials of managing your account effectively, understanding interest rates, and making the most of your savings.

Managing a savings account requires an understanding of its features and advantages. To set yourself up for success, you’ll want to familiarize yourself with the terms and conditions associated with your Chase Savings Account. Here are some strategies to consider:

One of the most attractive aspects of a Chase Savings Account is its interest rate. Ensuring you understand this rate is crucial for effectively using your account. Interest rates can vary based on several factors, including the current economic environment and your account balance. Chase typically offers a competitive rate, meaning that as your balance grows, so too does your potential interest earnings.

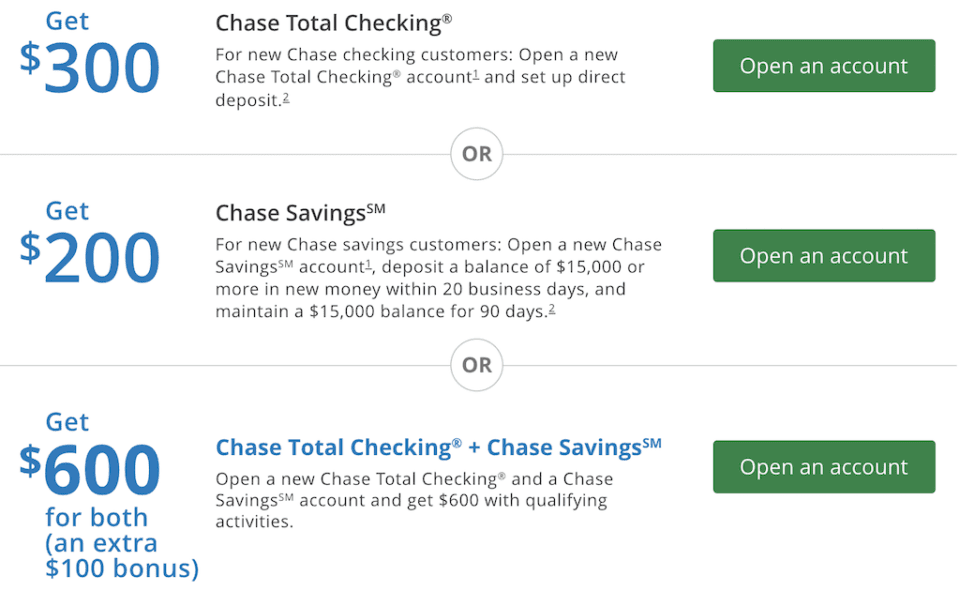

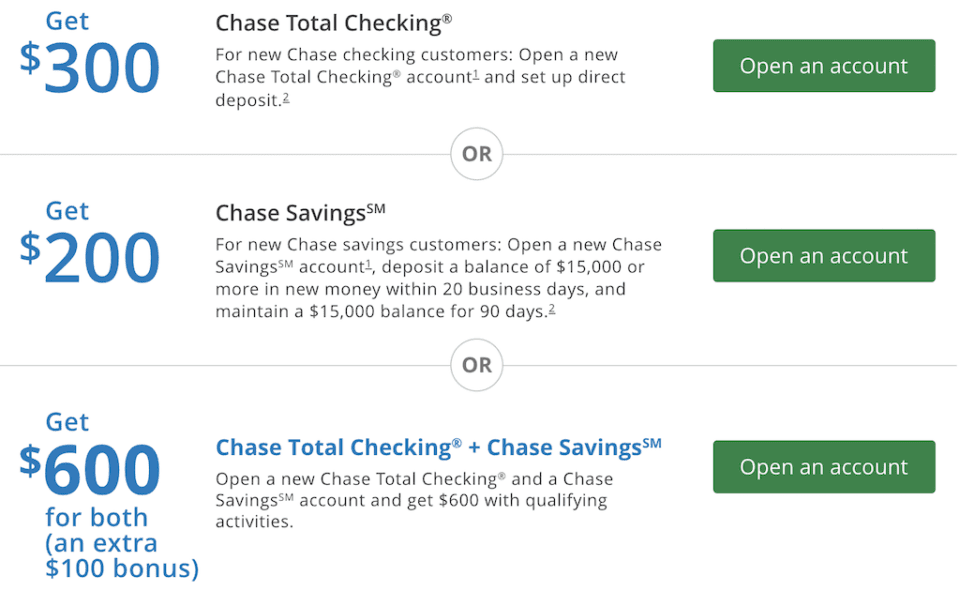

As you explore what to do with your Chase Savings Account further, keep this visual guide in mind. It summarizes key features, interest rates, and bonuses that may apply.

Once you’ve activated your Chase Savings Account, the next step is building up your savings effectively. Here are a few tips to help increase your savings:

While Chase savings accounts can be incredibly beneficial, understanding any associated fees is vital. Overdraft fees, maintenance fees, and withdrawal limitations can diminish your savings if you’re not careful. Always review the terms of your account and strive to maintain the required balance to avoid these costs.

What to do with your Chase Savings Account goes beyond just storing money. It’s about making strategic decisions that can put your savings to work for you. Here’s how to optimize your experience:

Checking your account regularly will allow you to monitor your progress and make any necessary adjustments to your strategy. If you notice that your savings growth is stagnating, consider increasing your contributions or reassessing your financial goals.

Chase provides an array of digital tools and resources to help you manage your savings effectively. From mobile banking apps to online calculators, these resources can aid you in tracking your savings progress and determining what to do with your Chase Savings Account.

If you’re considering a long-term investment strategy, think about what to do with your Chase Savings Account in combination with other financial products. Evaluate your options for CDs or higher-yield savings accounts that may offer better rates. Diversifying your savings strategy can enhance your financial health.

Any interest earned on your savings will be subject to income tax, so it’s essential to keep this in mind. Be prepared to report your income and understand how it impacts your overall tax situation. Learning what to do with your Chase Savings Account in relation to your tax obligations can help you plan better.

In summary, a Chase Savings Account can serve as a cornerstone of your financial management strategy. Whether you are saving for short-term goals or long-term investments, understanding how best to manage this account is crucial. By creating a solid savings plan, taking advantage of available tools, and avoiding fees, you can ensure that your Chase Savings Account works for you rather than the other way around.

Ultimately, your efforts will pay off in the form of increased savings and financial security. Remember, the first step to success is knowing what to do with your Chase Savings Account.